Fathom Digital Manufacturing Key Executives

This section highlights Fathom Digital Manufacturing's key executives, including their titles and compensation details.

Find Contacts at Fathom Digital Manufacturing

(Showing 0 of )

Fathom Digital Manufacturing Earnings

This section highlights Fathom Digital Manufacturing's earnings, including key dates, EPS, earnings reports, and earnings call transcripts.

Next Earnings Date

Last Earnings Results

Earnings Call Transcripts

| Transcript | Quarter | Year | Date | Estimated EPS | Actual EPS |

|---|---|---|---|---|---|

| Read Transcript | Q3 | 2023 | 2023-11-14 | $-1.00 | $-0.45 |

| Read Transcript | Q2 | 2023 | 2023-08-14 | $-0.72 | $-0.80 |

| Read Transcript | Q1 | 2023 | 2023-05-15 | $-0.01 | $-0.20 |

Financial Statements

Access annual & quarterly financial statements for Fathom Digital Manufacturing, including income statements, balance sheets, and cash flow statements..

Annual Income Statement

| Breakdown | December 31, 2023 | December 31, 2022 | December 31, 2021 | December 31, 2020 | December 31, 2019 |

|---|---|---|---|---|---|

| Revenue | $131.29M | $161.14M | $152.20M | $61.29M | $20.62M |

| Cost of Revenue | $112.09M | $108.62M | $92.39M | $33.06M | $10.70M |

| Gross Profit | $19.20M | $52.52M | $59.81M | $28.23M | $9.92M |

| Gross Profit Ratio | 14.60% | 32.59% | 39.30% | 46.05% | 48.12% |

| Research and Development Expenses | $- | $- | $- | $- | $- |

| General and Administrative Expenses | $- | $- | $- | $- | $- |

| Selling and Marketing Expenses | $- | $- | $- | $- | $- |

| Selling General and Administrative Expenses | $37.50M | $49.87M | $39.49M | $24.64M | $8.47M |

| Other Expenses | $27.75M | $18.18M | $10.61M | $4.67M | $- |

| Operating Expenses | $37.50M | $68.05M | $50.10M | $29.31M | $13.08M |

| Cost and Expenses | $149.59M | $176.67M | $142.48M | $62.38M | $23.77M |

| Interest Income | $- | $9.02M | $13.31M | $3.63M | $1.62M |

| Interest Expense | $15.57M | $9.02M | $12.32M | $3.63M | $- |

| Depreciation and Amortization | $25.14M | $18.18M | $10.61M | $7.24M | $2.66M |

| EBITDA | $6.84M | $101.46M | $36.34M | $2.91M | $2.50M |

| EBITDA Ratio | 5.21% | 62.96% | 23.88% | 4.75% | 12.14% |

| Operating Income | $-18.30M | $83.28M | $25.74M | $-4.33M | $-157.00K |

| Operating Income Ratio | -13.94% | 51.68% | 16.91% | -7.06% | -0.76% |

| Total Other Income Expenses Net | $16.78M | $-1.10B | $-34.53M | $-6.87M | $-4.61M |

| Income Before Tax | $-1.52M | $-1.12B | $13.42M | $-7.96M | $-4.77M |

| Income Before Tax Ratio | -1.16% | -693.27% | 8.82% | -12.99% | -23.14% |

| Income Tax Expense | $-79.00K | $-7.98M | $400.00K | $396.00K | $2.61M |

| Net Income | $16.06M | $-1.11B | $13.02M | $-8.36M | $-7.38M |

| Net Income Ratio | 12.23% | -688.32% | 8.55% | -13.64% | -35.81% |

| EPS | $4.64 | $-384.02 | $5.13 | $-3.88 | $-62.80 |

| EPS Diluted | $2.35 | $-384.02 | $5.13 | $-3.88 | $-62.77 |

| Weighted Average Shares Outstanding | 3.46M | 2.89M | 2.54M | 2.16M | 117.58K |

| Weighted Average Shares Outstanding Diluted | 6.82M | 2.89M | 2.54M | 2.16M | 117.63K |

| SEC Filing | Source | Source | Source | Source | Source |

| Breakdown | March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | March 31, 2023 | December 31, 2022 | September 30, 2022 | June 30, 2022 | March 31, 2022 | December 31, 2021 | September 30, 2021 | June 30, 2021 | March 31, 2021 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | $29.20M | $30.35M | $31.46M | $34.47M | $35.01M | $38.40M | $40.21M | $41.98M | $40.54M | $44.33M | $41.48M | $35.87M | $30.53M |

| Cost of Revenue | $25.85M | $28.05M | $23.19M | $23.94M | $23.06M | $28.42M | $25.14M | $26.44M | $28.54M | $26.29M | $26.58M | $22.38M | $17.12M |

| Gross Profit | $3.35M | $2.30M | $8.26M | $10.53M | $11.95M | $9.98M | $15.07M | $15.55M | $12.00M | $18.04M | $14.90M | $13.50M | $13.41M |

| Gross Profit Ratio | 11.50% | 7.60% | 26.30% | 30.60% | 34.10% | 26.00% | 37.50% | 37.00% | 29.60% | 40.70% | 35.90% | 37.60% | 43.90% |

| Research and Development Expenses | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- |

| General and Administrative Expenses | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- |

| Selling and Marketing Expenses | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- |

| Selling General and Administrative Expenses | $10.51M | $9.17M | $8.12M | $9.45M | $10.77M | $11.53M | $11.96M | $11.62M | $14.76M | $12.28M | $10.68M | $8.76M | $7.67M |

| Other Expenses | $1.00K | $28.32M | $5.34M | $1.72M | $4.58M | $4.58M | $4.63M | $4.45M | $4.52M | $21.60M | $-123.00K | $-683.00K | $-1.45M |

| Operating Expenses | $10.51M | $9.17M | $13.46M | $14.09M | $15.35M | $16.11M | $16.59M | $16.07M | $19.28M | $15.59M | $12.83M | $11.29M | $10.34M |

| Cost and Expenses | $36.36M | $37.22M | $36.66M | $38.03M | $38.41M | $44.53M | $41.73M | $42.51M | $47.82M | $41.88M | $39.41M | $33.67M | $27.46M |

| Interest Income | $4.23M | $- | $3.38M | $2.24M | $- | $3.28M | $- | $- | $- | $- | $- | $- | $- |

| Interest Expense | $4.23M | $4.15M | $3.99M | $3.96M | $3.47M | $3.35M | $2.41M | $1.86M | $1.47M | $3.54M | $4.38M | $2.31M | $2.11M |

| Depreciation and Amortization | $6.32M | $6.34M | $4.63M | $4.64M | $6.08M | $4.58M | $6.33M | $6.00M | $6.21M | $3.31M | $4.38M | $4.35M | $3.27M |

| EBITDA | $-843.00K | $-519.00K | $4.25M | $2.81M | $8.92M | $8.80M | $4.80M | $5.69M | $25.97M | $27.36M | $6.33M | $5.87M | $4.89M |

| EBITDA Ratio | -2.89% | -1.71% | 13.51% | 8.15% | 25.49% | 22.91% | 11.94% | 13.56% | 64.06% | 61.72% | 15.26% | 16.37% | 16.03% |

| Operating Income | $-7.16M | $-6.86M | $-5.20M | $-4.96M | $2.84M | $4.21M | $-1.53M | $-307.00K | $19.77M | $2.46M | $2.07M | $2.20M | $3.07M |

| Operating Income Ratio | -24.53% | -22.61% | -16.52% | -14.39% | 8.12% | 10.97% | -3.81% | -0.73% | 48.76% | 5.54% | 4.99% | 6.14% | 10.05% |

| Total Other Income Expenses Net | $-4.23M | $22.39M | $-3.38M | $-3.65M | $2.12M | $-105.30M | $-1.04B | $34.12M | $25.58M | $4.80M | $-4.82M | $-6.21M | $-3.56M |

| Income Before Tax | $-13.92M | $15.53M | $-8.58M | $-7.20M | $-1.28M | $-123.02M | $-1.05B | $33.60M | $18.29M | $20.52M | $-2.75M | $-4.01M | $-491.00K |

| Income Before Tax Ratio | -47.69% | 51.17% | -27.26% | -20.89% | -3.65% | -320.36% | -2601.39% | 80.03% | 45.12% | 46.28% | -6.62% | -11.19% | -1.61% |

| Income Tax Expense | $17.00K | $-189.00K | $-9.00K | $64.00K | $55.00K | $-8.15M | $87.00K | $-378.00K | $454.00K | $-464.00K | $729.00K | $69.00K | $9.00K |

| Net Income | $-7.36M | $21.43M | $-4.36M | $-7.26M | $-1.33M | $-114.88M | $-1.05B | $34.73M | $17.84M | $7.89M | $-3.48M | $-4.08M | $-500.00K |

| Net Income Ratio | -25.21% | 70.61% | -13.87% | -21.07% | -3.80% | -299.14% | -2601.61% | 82.71% | 44.00% | 17.80% | -8.38% | -11.38% | -1.64% |

| EPS | $-2.21 | $6.08 | $-1.24 | $-2.08 | $-0.40 | $-34.91 | $-333.07 | $5.20 | $2.65 | $7.75 | $-9.00 | $-10.57 | $-1.29 |

| EPS Diluted | $-2.21 | $6.08 | $-1.24 | $-2.08 | $-0.20 | $-34.91 | $-333.07 | $5.12 | $2.63 | $7.75 | $-9.00 | $-10.57 | $-1.29 |

| Weighted Average Shares Outstanding | 3.33M | 3.53M | 3.50M | 3.49M | 3.35M | 3.29M | 3.14M | 6.68M | 6.74M | 1.02M | 386.18K | 386.18K | 386.18K |

| Weighted Average Shares Outstanding Diluted | 3.33M | 3.53M | 3.50M | 3.49M | 6.81M | 3.29M | 3.14M | 6.78M | 6.79M | 1.02M | 386.18K | 386.18K | 386.18K |

| SEC Filing | Source | Source | Source | Source | Source | Source | Source | Source | Source | Source | Source | Source | Source |

Annual Balance Sheet

| Breakdown | December 31, 2023 | December 31, 2022 | December 31, 2021 | December 31, 2020 | December 31, 2019 |

|---|---|---|---|---|---|

| Cash and Cash Equivalents | $5.57M | $10.71M | $20.10M | $8.19M | $1.03M |

| Short Term Investments | $- | $- | $- | $- | $- |

| Cash and Short Term Investments | $5.57M | $10.71M | $20.10M | $8.19M | $1.03M |

| Net Receivables | $21.52M | $28.64M | $25.37M | $15.56M | $9.06M |

| Inventory | $10.02M | $15.72M | $10.54M | $6.33M | $1.70M |

| Other Current Assets | $2.02M | $220.00K | $4.46M | $2.60M | $538.00K |

| Total Current Assets | $39.13M | $58.66M | $57.98M | $32.67M | $12.33M |

| Property Plant Equipment Net | $57.22M | $60.27M | $42.38M | $26.39M | $10.81M |

| Goodwill | $- | $- | $1.24B | $63.22M | $33.01M |

| Intangible Assets | $233.27M | $251.41M | $249.57M | $83.47M | $36.09M |

| Goodwill and Intangible Assets | $233.27M | $251.41M | $1.49B | $146.68M | $69.10M |

| Long Term Investments | $- | $- | $- | $- | $- |

| Tax Assets | $- | $- | $- | $- | $- |

| Other Non-Current Assets | $142.00K | $175.00K | $9.81M | $1.04M | $1 |

| Total Non-Current Assets | $290.63M | $311.86M | $1.54B | $174.10M | $79.91M |

| Other Assets | $1 | $- | $- | $- | $- |

| Total Assets | $329.76M | $370.51M | $1.60B | $206.78M | $92.24M |

| Account Payables | $9.02M | $7.98M | $9.41M | $4.40M | $5.06M |

| Short Term Debt | $161.91M | $45.12M | $30.10M | $2.85M | $309.00K |

| Tax Payables | $- | $- | $- | $- | $- |

| Deferred Revenue | $683.00K | $767.00K | $4.39M | $4.18M | $- |

| Other Current Liabilities | $7.79M | $12.24M | $5.97M | $6.84M | $2.48M |

| Total Current Liabilities | $179.40M | $66.10M | $51.34M | $18.28M | $7.85M |

| Long Term Debt | $9.20M | $125.41M | $158.20M | $90.49M | $29.60M |

| Deferred Revenue Non-Current | $- | $- | $-17.57M | $- | $- |

| Deferred Tax Liabilities Non-Current | $- | $- | $17.57M | $- | $- |

| Other Non-Current Liabilities | $208.00K | $35.03M | $134.83M | $61.99M | $59.00K |

| Total Non-Current Liabilities | $9.41M | $160.44M | $218.46M | $152.48M | $29.66M |

| Other Liabilities | $- | $- | $- | $- | $- |

| Total Liabilities | $188.81M | $226.54M | $269.80M | $170.76M | $37.50M |

| Preferred Stock | $- | $- | $- | $54.10M | $31.84M |

| Common Stock | $- | $14.00K | $13.00K | $50.32M | $29.17M |

| Retained Earnings | $-521.74M | $-535.45M | $-1.58M | $-14.23M | $-6.27M |

| Accumulated Other Comprehensive Income Loss | $-107.00K | $-107.00K | $-0 | $-68.00K | $0 |

| Other Total Stockholders Equity | $594.40M | $585.58M | $420.35M | $-54.10M | $- |

| Total Stockholders Equity | $72.55M | $42.06M | $489.48M | $36.02M | $54.73M |

| Total Equity | $140.95M | $143.97M | $1.33B | $36.02M | $54.73M |

| Total Liabilities and Stockholders Equity | $329.76M | $370.51M | $1.60B | $206.78M | $92.24M |

| Minority Interest | $68.40M | $101.91M | $842.95M | $- | $- |

| Total Liabilities and Total Equity | $329.76M | $370.51M | $1.60B | $206.78M | $92.24M |

| Total Investments | $- | $- | $- | $- | $- |

| Total Debt | $171.11M | $170.53M | $151.01M | $93.34M | $29.91M |

| Net Debt | $165.54M | $159.81M | $130.91M | $85.15M | $28.88M |

Balance Sheet Charts

| Breakdown | March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | March 31, 2023 | December 31, 2022 | September 30, 2022 | June 30, 2022 | March 31, 2022 | December 31, 2021 | September 30, 2021 | June 30, 2021 | March 31, 2021 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash and Cash Equivalents | $2.28M | $5.57M | $7.82M | $10.73M | $12.13M | $10.71M | $8.00M | $11.12M | $11.99M | $20.10M | $331.11K | $1.53M | $1.65M |

| Short Term Investments | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $345.00M |

| Cash and Short Term Investments | $2.28M | $5.57M | $7.82M | $10.73M | $12.13M | $10.71M | $8.00M | $11.12M | $11.99M | $20.10M | $331.11K | $1.53M | $346.65M |

| Net Receivables | $20.73M | $21.52M | $22.04M | $24.50M | $26.27M | $28.64M | $27.24M | $26.40M | $28.16M | $25.37M | $- | $- | $- |

| Inventory | $10.23M | $10.02M | $16.78M | $17.18M | $16.77M | $15.72M | $15.83M | $14.10M | $12.54M | $10.54M | $- | $- | $- |

| Other Current Assets | $2.64M | $2.02M | $2.40M | $2.62M | $3.40M | $3.59M | $3.17M | $3.80M | $4.87M | $4.46M | $744.81K | $861.28K | $- |

| Total Current Assets | $35.87M | $39.13M | $49.04M | $55.02M | $58.58M | $58.66M | $54.24M | $55.42M | $57.56M | $57.98M | $1.08M | $2.39M | $2.66M |

| Property Plant Equipment Net | $53.47M | $57.22M | $58.63M | $60.42M | $60.61M | $60.27M | $62.28M | $57.35M | $57.47M | $42.38M | $- | $- | $- |

| Goodwill | $- | $- | $- | $- | $- | $- | $121.78M | $1.19B | $1.19B | $1.24B | $- | $- | $- |

| Intangible Assets | $228.74M | $233.27M | $237.81M | $242.34M | $246.88M | $251.41M | $255.95M | $260.48M | $265.02M | $249.57M | $- | $- | $- |

| Goodwill and Intangible Assets | $228.74M | $233.27M | $237.81M | $242.34M | $246.88M | $251.41M | $377.73M | $1.45B | $1.45B | $1.49B | $- | $- | $- |

| Long Term Investments | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $345.01M | $345.01M | $- |

| Tax Assets | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- |

| Other Non-Current Assets | $142.00K | $142.00K | $142.00K | $144.00K | $190.00K | $175.00K | $1.42M | $1.42M | $252.00K | $9.81M | $- | $- | $345.00M |

| Total Non-Current Assets | $282.34M | $290.63M | $296.58M | $302.90M | $307.68M | $311.86M | $441.42M | $1.51B | $1.51B | $1.54B | $345.01M | $345.01M | $345.00M |

| Other Assets | $- | $1 | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- |

| Total Assets | $318.22M | $329.76M | $345.62M | $357.93M | $366.26M | $370.51M | $495.66M | $1.56B | $1.57B | $1.60B | $346.09M | $347.39M | $347.66M |

| Account Payables | $13.38M | $9.02M | $9.40M | $10.31M | $7.28M | $7.98M | $11.78M | $11.47M | $13.86M | $9.41M | $- | $- | $- |

| Short Term Debt | $158.94M | $161.91M | $159.46M | $51.40M | $50.67M | $45.12M | $34.31M | $34.34M | $28.55M | $30.10M | $- | $- | $- |

| Tax Payables | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- |

| Deferred Revenue | $1 | $683.00K | $7.69M | $8.15M | $- | $767.00K | $- | $- | $- | $4.39M | $- | $- | $- |

| Other Current Liabilities | $9.15M | $7.79M | $2.67M | $3.48M | $13.32M | $12.24M | $10.90M | $11.72M | $14.57M | $5.97M | $263.50K | $453.25K | $2.06M |

| Total Current Liabilities | $181.47M | $179.40M | $179.23M | $73.34M | $71.27M | $66.10M | $56.99M | $57.53M | $56.97M | $51.34M | $263.50K | $453.25K | $2.06M |

| Long Term Debt | $8.66M | $9.20M | $9.71M | $119.84M | $122.54M | $125.41M | $127.40M | $125.06M | $127.28M | $158.20M | $- | $- | $- |

| Deferred Revenue Non-Current | $- | $- | $- | $- | $- | $- | $- | $- | $- | $3.64M | $- | $- | $- |

| Deferred Tax Liabilities Non-Current | $- | $- | $- | $- | $- | $- | $- | $12.34M | $17.55M | $17.57M | $- | $- | $- |

| Other Non-Current Liabilities | $208.00K | $208.00K | $26.32M | $29.81M | $31.22M | $35.03M | $45.70M | $54.48M | $87.57M | $113.62M | $31.72M | $35.44M | $47.98M |

| Total Non-Current Liabilities | $8.87M | $9.41M | $36.03M | $149.64M | $153.76M | $160.44M | $173.10M | $191.88M | $232.39M | $218.46M | $31.72M | $35.44M | $47.98M |

| Other Liabilities | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- |

| Total Liabilities | $190.34M | $188.81M | $215.26M | $222.99M | $225.03M | $226.54M | $230.10M | $249.41M | $289.37M | $269.80M | $31.98M | $35.89M | $50.04M |

| Preferred Stock | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- |

| Common Stock | $- | $- | $- | $14.00K | $14.00K | $14.00K | $13.00K | $13.00K | $13.00K | $13.00K | $345.00M | $306.50M | $292.63M |

| Retained Earnings | $-529.10M | $-521.74M | $-541.46M | $-537.09M | $-533.97M | $-535.45M | $-480.17M | $9.91M | $-24.51M | $-1.58M | $-30.89M | $-1.85M | $-15.73M |

| Accumulated Other Comprehensive Income Loss | $-107.00K | $-107.00K | $-107.00K | $-107.00K | $-107.00K | $-107.00K | $- | $-0 | $- | $- | $- | $- | $- |

| Other Total Stockholders Equity | $595.07M | $594.40M | $595.78M | $592.07M | $591.01M | $577.60M | $584.31M | $554.16M | $468.48M | $420.35M | $-345.00M | $-299.65M | $-271.90M |

| Total Stockholders Equity | $65.86M | $72.55M | $54.22M | $54.88M | $56.95M | $42.06M | $104.16M | $564.09M | $443.98M | $489.48M | $-30.89M | $5.00M | $5.00M |

| Total Equity | $127.88M | $140.95M | $130.37M | $134.94M | $141.23M | $143.97M | $265.57M | $1.31B | $1.28B | $1.33B | $-30.89M | $5.00M | $5.00M |

| Total Liabilities and Stockholders Equity | $318.22M | $329.76M | $345.62M | $357.93M | $366.26M | $370.51M | $495.66M | $1.56B | $1.57B | $1.60B | $1.09M | $40.89M | $55.04M |

| Minority Interest | $62.02M | $68.40M | $76.14M | $80.06M | $84.28M | $101.91M | $161.41M | $749.62M | $836.72M | $842.95M | $- | $- | $- |

| Total Liabilities and Total Equity | $318.22M | $329.76M | $345.62M | $357.93M | $366.26M | $370.51M | $495.66M | $1.56B | $1.57B | $1.60B | $1.09M | $40.89M | $55.04M |

| Total Investments | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $345.01M | $345.01M | $345.00M |

| Total Debt | $167.60M | $171.11M | $169.17M | $171.24M | $173.21M | $170.53M | $161.72M | $159.41M | $155.82M | $151.01M | $- | $- | $- |

| Net Debt | $165.33M | $165.54M | $161.35M | $160.50M | $161.08M | $159.81M | $153.71M | $148.29M | $143.83M | $130.91M | $-331.11K | $-1.53M | $-1.65M |

Annual Cash Flow

| Breakdown | December 31, 2023 | December 31, 2022 | December 31, 2021 | December 31, 2020 | December 31, 2019 |

|---|---|---|---|---|---|

| Net Income | $16.06M | $-488.58M | $-16.47M | $-7.96M | $-4.77M |

| Depreciation and Amortization | $25.14M | $24.90M | $16.11M | $7.24M | $2.66M |

| Deferred Income Tax | $-4.96M | $-6.42M | $1.20M | $369.00K | $3.82M |

| Stock Based Compensation | $4.13M | $7.39M | $2.65M | $34.00K | $21.00K |

| Change in Working Capital | $6.66M | $-8.20M | $4.16M | $931.00K | $-1.67M |

| Accounts Receivables | $6.93M | $-4.18M | $-5.40M | $1.06M | $-4.06M |

| Inventory | $1.32M | $-5.79M | $-961.00K | $-356.00K | $216.00K |

| Accounts Payables | $-3.28M | $-1.17M | $9.54M | $595.00K | $- |

| Other Working Capital | $1.70M | $2.94M | $988.00K | $-371.00K | $2.17M |

| Other Non Cash Items | $-48.67M | $474.00M | $-424.00K | $1.26M | $3.17M |

| Net Cash Provided by Operating Activities | $-1.65M | $3.08M | $7.22M | $1.87M | $-591.00K |

| Investments in Property Plant and Equipment | $-4.99M | $-13.19M | $-8.97M | $-1.63M | $-729.00K |

| Acquisitions Net | $- | $- | $-67.43M | $-94.41M | $-43.64M |

| Purchases of Investments | $- | $- | $- | $- | $- |

| Sales Maturities of Investments | $- | $- | $- | $- | $- |

| Other Investing Activities | $- | $- | $- | $- | $- |

| Net Cash Used for Investing Activities | $-4.99M | $-13.19M | $-76.40M | $-96.04M | $-44.37M |

| Debt Repayment | $- | $- | $- | $- | $- |

| Common Stock Issued | $134.00K | $150.00K | $- | $40.45M | $- |

| Common Stock Repurchased | $- | $-2.98M | $- | $- | $- |

| Dividends Paid | $- | $- | $- | $- | $-128.00K |

| Other Financing Activities | $1.50M | $572.00K | $70.57M | $101.33M | $43.89M |

| Net Cash Used Provided by Financing Activities | $1.50M | $572.00K | $70.57M | $101.33M | $43.77M |

| Effect of Forex Changes on Cash | $- | $-107.00K | $- | $- | $2.22M |

| Net Change in Cash | $-5.14M | $-9.64M | $1.39M | $7.16M | $1.03M |

| Cash at End of Period | $5.57M | $10.71M | $9.58M | $8.19M | $1.03M |

| Cash at Beginning of Period | $10.71M | $20.36M | $8.19M | $1.03M | $- |

| Operating Cash Flow | $-1.65M | $3.08M | $7.22M | $1.87M | $-591.00K |

| Capital Expenditure | $-4.99M | $-13.19M | $-8.97M | $-1.63M | $-729.00K |

| Free Cash Flow | $-6.64M | $-10.11M | $-1.75M | $244.00K | $-1.32M |

Cash Flow Charts

| Breakdown | March 31, 2024 | December 31, 2023 | September 30, 2023 | June 30, 2023 | March 31, 2023 | December 31, 2022 | September 30, 2022 | June 30, 2022 | March 31, 2022 | December 31, 2021 | September 30, 2021 | June 30, 2021 | March 31, 2021 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Income | $-7.36M | $21.43M | $-4.36M | $-3.12M | $2.12M | $-56.02M | $-490.08M | $34.42M | $23.10M | $-8.42M | $-3.48M | $-4.08M | $-500.00K |

| Depreciation and Amortization | $6.32M | $6.34M | $6.25M | $6.46M | $6.08M | $6.36M | $6.33M | $6.00M | $6.21M | $4.10M | $4.38M | $4.35M | $3.27M |

| Deferred Income Tax | $- | $-442.00K | $442.00K | $64.00K | $- | $-6.37M | $687.00K | $-710.00K | $-24.00K | $374.00K | $- | $-1.45M | $- |

| Stock Based Compensation | $865.00K | $656.00K | $1.14M | $1.24M | $1.09M | $1.70M | $1.76M | $1.79M | $2.13M | $2.62M | $- | $31.00K | $- |

| Change in Working Capital | $4.36M | $1.76M | $1.68M | $2.42M | $796.00K | $-2.51M | $-2.02M | $-2.00M | $-1.67M | $7.45M | $-3.48M | $1.09M | $-907.00K |

| Accounts Receivables | $788.00K | $513.00K | $2.34M | $1.60M | $2.47M | $-1.91M | $-840.00K | $1.36M | $-2.79M | $-632.00K | $-4.76M | $-898.00K | $890.00K |

| Inventory | $-211.00K | $2.38M | $398.00K | $-406.00K | $-1.05M | $113.00K | $-1.73M | $-1.56M | $-2.62M | $-410.00K | $333.00K | $-1.09M | $202.00K |

| Accounts Payables | $4.09M | $-4.33M | $-162.00K | $2.44M | $-1.23M | $285.00K | $-1.13M | $-4.39M | $4.06M | $8.68M | $231.00K | $41.00K | $594.00K |

| Other Working Capital | $-306.00K | $3.20M | $-892.00K | $-1.21M | $-193.00K | $-995.00K | $1.68M | $2.58M | $-322.00K | $-179.00K | $725.00K | $3.04M | $-2.59M |

| Other Non Cash Items | $4.91M | $-33.65M | $-5.02M | $-5.44M | $-9.58M | $53.42M | $485.66M | $-36.18M | $-28.90M | $-646.00K | $3.35M | $-1.11M | $266.00K |

| Net Cash Provided by Operating Activities | $263.00K | $-3.90M | $127.00K | $1.62M | $500.00K | $-3.42M | $2.34M | $3.32M | $840.00K | $5.49M | $776.00K | $-1.17M | $2.13M |

| Investments in Property Plant and Equipment | $-277.00K | $-720.00K | $-1.24M | $-1.12M | $-1.92M | $-2.24M | $-4.28M | $-3.33M | $-3.35M | $-2.32M | $-3.71M | $-1.59M | $-1.35M |

| Acquisitions Net | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $-56.59M | $-10.84M |

| Purchases of Investments | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- |

| Sales Maturities of Investments | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- |

| Other Investing Activities | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- |

| Net Cash Used for Investing Activities | $-277.00K | $-720.00K | $-1.24M | $-1.12M | $-1.92M | $-2.24M | $-4.28M | $-3.33M | $-3.35M | $-2.32M | $-3.71M | $-58.19M | $-12.18M |

| Debt Repayment | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- |

| Common Stock Issued | $- | $48.00K | $- | $86.00K | $- | $150.00K | $- | $- | $- | $- | $- | $- | $- |

| Common Stock Repurchased | $- | $- | $- | $- | $- | $-410.00K | $-308.00K | $-2.26M | $- | $- | $- | $- | $- |

| Dividends Paid | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- |

| Other Financing Activities | $-3.28M | $2.37M | $-1.80M | $-1.90M | $2.83M | $8.47M | $-1.17M | $-869.00K | $-5.86M | $-4.12M | $-1.28M | $64.69M | $11.27M |

| Net Cash Used Provided by Financing Activities | $-3.28M | $2.37M | $-1.80M | $-1.90M | $2.83M | $8.47M | $-1.17M | $-869.00K | $-5.86M | $-4.12M | $-1.28M | $64.69M | $11.27M |

| Effect of Forex Changes on Cash | $- | $1.04B | $-1.04B | $- | $- | $-107.00K | $- | $- | $-107.00K | $- | $- | $- | $- |

| Net Change in Cash | $-3.30M | $-2.25M | $-2.91M | $-1.40M | $1.42M | $2.71M | $-3.11M | $-875.00K | $-8.36M | $-954.00K | $-4.21M | $5.34M | $1.22M |

| Cash at End of Period | $2.28M | $5.57M | $7.82M | $10.73M | $12.13M | $10.71M | $8.00M | $11.12M | $11.99M | $9.58M | $10.53M | $14.74M | $9.41M |

| Cash at Beginning of Period | $5.57M | $7.82M | $10.73M | $12.13M | $10.71M | $8.00M | $11.12M | $11.99M | $20.36M | $10.53M | $14.74M | $9.41M | $8.19M |

| Operating Cash Flow | $263.00K | $-3.90M | $127.00K | $1.62M | $500.00K | $-3.42M | $2.34M | $3.32M | $840.00K | $5.49M | $776.00K | $-1.17M | $2.13M |

| Capital Expenditure | $-277.00K | $-720.00K | $-1.24M | $-1.12M | $-1.92M | $-2.24M | $-4.28M | $-3.33M | $-3.35M | $-2.32M | $-3.71M | $-1.59M | $-1.35M |

| Free Cash Flow | $-14.00K | $-4.62M | $-1.11M | $504.00K | $-1.42M | $-5.65M | $-1.95M | $-6.00K | $-2.51M | $3.16M | $-2.93M | $-2.76M | $782.00K |

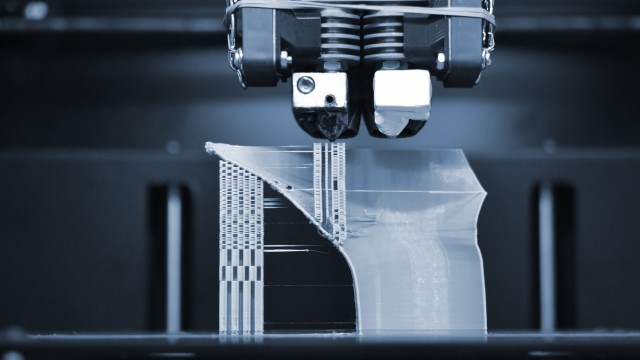

Fathom Digital Manufacturing Corporation, a digital manufacturing platform, provides product development and manufacturing services in North America. It provides plastic and metal additive manufacturing, computer numerical control machining, injection molding and tooling, precision sheet metal fabrication, design engineering, urethane casting, and chemical etching. The company serves the technology, defense, aerospace, medical, automotive, and IOT sectors. The company was founded in 1984 and is headquartered in Hartland, Wisconsin.

$5.05

Stock Price

$34.68M

Market Cap

576

Employees

Hartland, WI

Location

Revenue (FY 2023)

$131.29M

-18.5% YoY

Net Income (FY 2023)

$16.06M

101.4% YoY

EPS (FY 2023)

$2.35

100.6% YoY

Free Cash Flow (FY 2023)

$-6.64M

34.3% YoY

Profitability

Gross Margin

14.6%

Net Margin

12.2%

ROE

22.1%

ROA

4.9%

Valuation

P/E Ratio

0.96

P/S Ratio

0.12

EV/EBITDA

26.48

Market Cap

$34.68M

Revenue & Net Income

Profit Margins

Cash Flow Summary

Operating Cash Flow

$-1.65M

-153.5% YoY

Free Cash Flow

$-6.64M

34.3% YoY

Balance Sheet Summary

Total Assets

$329.76M

-11.0% YoY

Total Debt

$171.11M

0.3% YoY

Shareholder Equity

$72.55M

-18.4% YoY

Dividend Overview

No Dividend Data

Fathom Digital Manufacturing Corporation doesn't currently pay dividends.

Fathom Digital Manufacturing Dividends

Explore Fathom Digital Manufacturing's dividend history, including dividend yield, payout ratio, and historical payments.

Fathom Digital Manufacturing News

Read the latest news about Fathom Digital Manufacturing, including recent articles, headlines, and updates.

Fathom Digital Manufacturing Corporation Receives Non-Binding Acquisition Proposal From CORE Industrial Partners

HARTLAND, Wis.--(BUSINESS WIRE)--Fathom Digital Manufacturing Corp. (NYSE: FATH), an industry leader in on-demand digital manufacturing services, today announced that it has received a non-binding proposal from CORE Industrial Partners, LLC on behalf of itself and its affiliated investment vehicles, (collectively, the "CORE Funds”), to acquire all of the Company's outstanding shares of Class A Common Stock and Class B Common Stock that they do not already own for $4.50 cash per share. The non-b.

Fathom Digital Manufacturing to Hold Third Quarter 2023 Conference Call on Tuesday, November 14, 2023 at 8:30 am ET

HARTLAND, Wis.--(BUSINESS WIRE)--Fathom Digital Manufacturing Corp. (NYSE: FATH) (“Fathom” or the “Company”), an industry leader in on-demand digital manufacturing services, today announced that it plans to issue financial results for the third quarter ended September 30, 2023 on Tuesday, November 14, 2023 before the open of market trading. Fathom will also hold a conference call the same day at 8:30 am Eastern Time. To participate in the conference call, please dial +1-833-470-1428 (US) or +1-.

Fathom Digital Manufacturing Corporation Appoints Carey Chen as Chief Executive Officer

HARTLAND, Wis.--(BUSINESS WIRE)--Fathom Digital Manufacturing Corp. (NYSE: FATH) (“Fathom” or the “Company”), an industry leader in on-demand digital manufacturing services, today announced that its Board of Directors has appointed Carey Chen as Chief Executive Officer of the Company. Mr. Chen will succeed Ryan Martin, effective immediately. Mr. Chen has served as a member of Fathom's Board of Directors since the Company became publicly listed in 2021 and served as a director of Fathom's predec.

Fathom Digital Manufacturing Corporation Reports Inducement Equity Grant Pursuant to NYSE Rule 303A.08

HARTLAND, Wis.--(BUSINESS WIRE)--Fathom Digital Manufacturing Corp. (NYSE: FATH) (“Fathom” or the “Company”), an industry leader in on-demand digital manufacturing services, today announced that it has granted to Carey Chen inducement equity awards covering an aggregate of 256,426 shares of Fathom common stock as a material inducement for Mr. Chen to accept his appointment as Chief Executive Officer of Fathom. The equity awards, consisting of grants of 151,515 time-vesting restricted stock unit.

Fathom Digital Manufacturing 1-for-20 Reverse Stock Split Becomes Effective

HARTLAND, Wis.--(BUSINESS WIRE)--Fathom Digital Manufacturing Corp. (“Fathom” or the “Company”) (NYSE: FATH), an industry leader in on-demand digital manufacturing services, today announced that its previously announced 1-for-20 reverse stock split of the Company's common stock, par value $0.0001 per share, and corresponding common stock adjustment became effective on September 28, 2023. The Company's Class A common stock is expected to begin trading on a split-adjusted basis on the New York St.

NYSE to Commence Delisting Proceedings with Respect to the Warrants of Fathom Digital Manufacturing Corporation (FATH.WS)

NEW YORK--(BUSINESS WIRE)--The New York Stock Exchange (“NYSE”, the “Exchange”) announced today that the staff of NYSE Regulation has determined to commence proceedings to delist the warrants to purchase Class A common stock (the “Warrants”) — ticker symbol FATH.WS — of Fathom Digital Manufacturing Corporation (the “Company”) from the NYSE. Trading in the Company's Warrants will be suspended immediately. Trading in the Company's Class A common stock — ticker symbol FATH — will continue on the N.

Fathom Digital Manufacturing Announces 1-for-20 Reverse Stock Split

HARTLAND, Wis.--(BUSINESS WIRE)--Fathom Digital Manufacturing Corp. (“Fathom” or the “Company”) (NYSE: FATH), an industry leader in on-demand digital manufacturing services, today announced its Board of Directors approved a 1-for-20 reverse stock split of the Company's common stock that will become effective after the close of market trading on September 28, 2023. The reverse stock split was approved by the Company's stockholders on July 11, 2023 at the Company's annual meeting of stockholders,.

Fathom Digital Manufacturing Corporation (FATH) Q2 2023 Earnings Call Transcript

Fathom Digital Manufacturing Corporation (NYSE:FATH ) Q2 2023 Earnings Conference Call August 14, 2023 8:30 AM ET Company Participants Michael Cimini - Director, Investor Relations Ryan Martin - CEO Mark Frost - CFO Conference Call Participants James Ricchiuti - Needham & Company Greg Palm - Craig-Hallum Capital Group Hello. My name is Carla, and I will be your operator this morning.

Fathom Digital Manufacturing Reports Second Quarter 2023 Financial Results

HARTLAND, Wis.--(BUSINESS WIRE)--Fathom Digital Manufacturing Corp. (NYSE: FATH), an industry leader in on-demand digital manufacturing services, today announced financial results for the second quarter and six months ended June 30, 2023. Three Months Ended Six Months Ended ($ in thousands) 6/30/2023 6/30/2022 6/30/2023 6/30/2022 Revenue $34,474 $41,985 $69,481 $82,526 Net income (loss) $(7,264) $34,284 $(8,595) $53,278 Adjusted net income (loss)1 $(5,669) $1,497 $(11,171) $696 Adju.

Fathom Digital Manufacturing to Hold Second Quarter 2023 Conference Call on Monday, August 14 at 8:30 am ET

HARTLAND, Wis.--(BUSINESS WIRE)--Fathom Digital Manufacturing Corp. (NYSE: FATH), an industry leader in on-demand digital manufacturing services, today announced that it plans to issue financial results for the second quarter ended June 30, 2023 on Monday, August 14, 2023 before the open of market trading. Fathom will also hold a conference call the same day at 8:30 am Eastern Time. To participate in the conference call, please dial +1-833-470-1428 (US) or +1-404-975-4839 (international) and us.

Fathom Digital Manufacturing Corporation (FATH) Q1 2023 Earnings Call Transcript

Fathom Digital Manufacturing Corporation (NYSE:FATH ) Q1 2023 Earnings Conference Call May 15, 2023 8:30 AM ET Company Participants Michael Cimini - Director of Investor Relations Ryan Martin - Chief Executive Officer Mark Frost - Chief Financial Officer Conference Call Participants Jim Ricchiuti - Needham & Company Greg Palm - Craig-Hallum Capital Group Paul Chung - JP Morgan Operator Hello, ladies and gentlemen. My name is Glenn, and I will be the operator this morning.

Fathom Digital Manufacturing: Early Stages In A Large Market Opportunity

Fathom has core competence across additive manufacturing and more traditional methods. Currently sitting at 12 sites, I believe Fathom is poised to gain market share given speed with its growth strategy and optimization plans in place.

Fathom Digital: Part Of The Industry 4.0 Revolution

Fathom Digital Manufacturing bills itself as one of the largest digital manufacturing platforms in North America. Fathom Digital's functions are a hybrid between the traditional industrial manufacturing terms and the technological development typical of industry 4.0.

Fathom Digital Manufacturing Corporation (FATH) Q3 2022 Earnings Call Transcript

Fathom Digital Manufacturing Corporation (NYSE:FATH ) Q3 2022 Earnings Conference Call November 14, 2022 8:30 AM ET Company Participants Michael Cimini - Director of IR Ryan Martin - CEO Mark Frost - CFO Conference Call Participants Greg Palm - Craig-Hallum Capital Group Jim Ricchiuti - Needham & Co. Wamsi Mohan - Bank of America Paul Chung - JPMorgan Jacob Stephan - Lake Street Capital Markets Operator Hello. My name is Emily, and I will be your operator this morning.

Fathom Digital Manufacturing Reports Third Quarter 2022 Financial Results

HARTLAND, Wis.--(BUSINESS WIRE)--Fathom Digital Manufacturing Corp. (NYSE: FATH), an industry leader in on-demand digital manufacturing services, today announced financial results for the three and nine months ended September 30, 2022. Three Months Ended Nine Months Ended ($ in thousands) 9/30/2022 9/30/2021 9/30/2022 9/30/2021 Revenue $40,210 $41,481 $122,737 $107,887 Net loss $(1,046,107) $(3,476) $(994,295) $(8,058) Adjusted net income (loss)1 $(1,773) $(1,074) $(2,544) $1,296 Adjusted EBITDA1 $7,056 $8,647 $21,900 $23,820 Adjusted EBITDA margin1 17.5% 20.8% 17.8% 22.1% 1 See “Non-GAAP Financial Information.” Reconciliations of non-GAAP financial measures are included in the appendix. “Our results for the third quarter were in-line with management’s expectations as Fathom extended its proven track record of profitability in the company’s core operations and cash generation despite the challenging macro environment,” said Ryan Martin, Fathom Chief Executive Officer. “We also continue to build positive momentum for our new commercial activities as both orders and revenue achieved monthly sequential growth throughout the quarter, highlighted by record orders for our additive manufacturing services in the month of September. Our focus remains on accelerating engagement with Fortune 500-tier customers and increasing the scalability of our robust on-demand digital manufacturing platform to drive long-term profitable growth.” Summary of Financial Results Revenue for the third quarter of 2022 was $40.2 million compared to $41.5 million in the third quarter of 2021, a decrease of 3.1% primarily due to lower volumes. For the nine months ended September 30, 2022, revenue increased 13.8% to $122.7 million from $107.8 million for the same period in 2021 with higher sales driven by acquisition-related activity and growth within Fathom’s strategic accounts. Gross profit for the third quarter of 2022 totaled $15.1 million, or 37.5% of revenue, compared to $14.9 million, or 35.9% of revenue, in the third quarter of 2021. Gross profit for the nine months ended September 30, 2022 was $42.6 million, or 34.7% of revenue, which includes approximately $3.2 million in non-cash purchase accounting adjustments, compared to $41.8 million, or 38.7% of revenue, for the same period in 2021. Excluding the $3.2 million in non-cash purchase accounting adjustments, gross profit for the nine months ended September 30, 2022 totaled $45.8 million, or 37.3% of revenue. Net loss for the third quarter of 2022 was $(1,046.1) million compared to a net loss of $(3.5) million in the third quarter of 2021. Net loss for the third quarter of 2022 included a non-cash goodwill impairment charge of $1,066.6 million as the result of an interim impairment analysis, which was triggered by the sustained decline in Fathom’s share price, lower market multiples for a relevant peer group, higher discount rate due to the rising interest rate environment and challenging macroeconomic conditions. The impairment charge has no impact on the company’s cash position, liquidity, or covenant tests under its credit agreement. Excluding goodwill impairment as well as the revaluation of Fathom warrants and earnout shares, stock compensation expense, and other costs, Fathom reported an adjusted net loss in the third quarter of 2022 of $(1.8) million compared to an adjusted net loss of $(1.1) million for the same period in 2021. Net loss for the nine months ended September 30, 2022 was $(994.3) million compared to a net loss of $(8.1) million for the same period in 2021. For the nine months ended September 30, 2022, Fathom reported an adjusted net loss of $(2.5) million compared to adjusted net income of $1.3 million for the same period in 2021. Adjusted EBITDA for the third quarter of 2022 totaled $7.1 million versus $8.6 million for the same period in 2021 primarily due to lower volumes as well as the incurrence of public company expenses totaling approximately $2.1 million. The Adjusted EBITDA margin in the quarter was 17.5% compared to 20.8% in the third quarter of 2021. For the nine months ended September 30, 2022, Adjusted EBITDA totaled $21.9 million versus $23.8 million for the same period in 2021 primarily due to recurring public company expenses totaling approximately $6.4 million. The Adjusted EBITDA margin for the nine months ended September 30, 2022 was 17.8% compared to 22.1% for the same period in 2021. 2022 Outlook For the full year 2022, Fathom expects revenue to range between $163 million and $165 million, representing year-over-year growth of approximately 7% to 8.5%. Fathom also expects Adjusted EBITDA to range between $30 million and $32 million, representing a year-over-year decrease of approximately (12.5%) to (7%) and an implied Adjusted EBITDA margin of 18.4% to 19.4%. This outlook, as of November 14, 2022, reflects management’s current projections and macroeconomic outlook, and excludes the impact of any potential acquisitions. Conference Call Fathom will host a conference call on Monday, November 14, 2022, at 8:30 am Eastern Time. The dial-in number for callers in the U.S. is +1-844-200-6205 and the dial-in number for international callers is +1-929-526-1599. The access code for all callers is 412487. The conference call will be broadcast live over the Internet and include a slide presentation. To access the webcast and supporting materials, please visit the investor relations section of Fathom’s website at https://investors.fathommfg.com. A replay of the conference call can be accessed through November 21, 2022, by dialing +1-866-813-9403 (US) or +1-226-828-7578 (international), and then entering the access code 414890. The webcast will also be archived on Fathom’s website. About Fathom Digital Manufacturing Fathom is one of the largest on-demand digital manufacturing platforms in North America, serving the comprehensive product development and low- to mid-volume manufacturing needs of some of the largest and most innovative companies in the world. With more than 25 unique manufacturing processes and a national footprint with nearly 450,000 square feet of manufacturing capacity across 12 facilities, Fathom seamlessly blends in-house capabilities across plastic and metal additive technologies, CNC machining, injection molding and tooling, sheet metal fabrication, and design and engineering. With more than 35 years of industry experience, Fathom is at the forefront of the Industry 4.0 digital manufacturing revolution, serving clients in the technology, defense, aerospace, medical, automotive and IOT sectors. Fathom's certifications include: ITAR Registered, ISO 9001:2015 Design Certified, ISO 9001:2015, ISO 13485:2016, AS9100:2016, and NIST 800-171. To learn more, visit https://fathommfg.com/. Forward-Looking Statements Certain statements made in this press release are “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Words such as “estimates,” “projects,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “would,” “should,” “future,” “propose,” “target,” “goal,” “objective,” “outlook” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the control of Fathom Digital Manufacturing Corporation (“Fathom”) that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include: the inability to recognize the anticipated benefits of our business combination with Altimar Acquisition Corp. II; changes in general economic conditions, including as a result of the COVID-19 pandemic; the outcome of litigation related to or arising out of the business combination, or any adverse developments therein or delays or costs resulting therefrom; the ability to meet the New York Stock Exchange’s listing standards following the consummation of the business combination; costs related to the business combination and additional factors discussed in Fathom’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the Securities and Exchange Commission (the “SEC”) on April 8, 2022 as well as Fathom’s other filings with the SEC. If any of the risks described above materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by our forward-looking statements. There may be additional risks that Fathom does not presently know or that Fathom currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Fathom’s expectations, plans or forecasts of future events and views as of the date of this press release. These forward-looking statements should not be relied upon as representing Fathom’s assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements. Fathom undertakes no obligation to update or revise any forward-looking statements made by management or on its behalf, including with respect to the financial guidance for full year 2022 contained herein, whether as a result of future developments, subsequent events or circumstances or otherwise, except as required by law. Non-GAAP Financial Information This press release includes Adjusted Net Income, Adjusted EBITDA and Adjusted EBITDA margin, which are non-GAAP financial measures that we use to supplement our results presented in accordance with U.S. GAAP. We believe Adjusted Net Income, Adjusted EBITDA and Adjusted EBITDA margin are useful in evaluating our operating performance, as they are similar to measures reported by our public competitors and regularly used by security analysts, institutional investors and other interested parties in analyzing operating performance and prospects. Adjusted Net Income, Adjusted EBITDA and Adjusted EBITDA margin are not intended to be a substitute for any U.S. GAAP financial measure and, as calculated, may not be comparable to other similarly titled measures of performance of other companies in other industries or within the same industry. We define and calculate Adjusted Net Income as net income (loss) before the impact of any change in the estimated fair value of the company’s warrants or earnout shares, reorganization expenses, goodwill impairment, stock-based compensation, and certain other non-cash and non-core items, as described in the reconciliation included in the appendix to this press release. We define and calculate Adjusted EBITDA as net income (loss) before the impact of interest income or expense, income tax expense and depreciation and amortization, and further adjusted for the following items: change in the estimated fair value of the company’s warrants or earnout shares, reorganization expenses, goodwill impairment, stock-based compensation, and certain other non-cash and non-core items, as described in the reconciliation included in the appendix to this press release. Adjusted EBITDA excludes certain expenses that are required in accordance with U.S. GAAP because they are non-recurring (for example, in the case of reorganization expenses), non-cash (for example, in the case of depreciation, amortization, goodwill impairment, and stock-based compensation) or are not related to our underlying business performance (for example, in the case of interest income and expense). Adjusted EBITDA margin represents Adjusted EBITDA divided by total revenue. We include these non-GAAP financial measures because they are used by management to evaluate Fathom’s core operating performance and trends and to make strategic decisions regarding the allocation of capital and new investments. Information reconciling forward-looking Adjusted EBITDA to GAAP financial measures is unavailable to Fathom without unreasonable effort. The company is not able to provide reconciliations of forward-looking Adjusted EBITDA to GAAP financial measures because certain items required for such reconciliations are outside of Fathom's control and/or cannot be reasonably predicted, such as the provision for income taxes. Preparation of such reconciliations would require a forward-looking balance sheet, statement of income and statement of cash flow, prepared in accordance with GAAP, and such forward-looking financial statements are unavailable to Fathom without unreasonable effort. Fathom provides a range for its Adjusted EBITDA forecast that it believes will be achieved, however it cannot accurately predict all the components of the Adjusted EBITDA calculation. Fathom provides an Adjusted EBITDA forecast because it believes that Adjusted EBITDA, when viewed with the company's results under GAAP, provides useful information for the reasons noted above. However, Adjusted EBITDA is not a measure of financial performance or liquidity under GAAP and, accordingly, should not be considered as an alternative to net income or cash flow from operating activities as an indicator of operating performance or liquidity. Consolidated Statements of Comprehensive Income (Loss) ($ in thousands) Three Months Ended Nine Months Ended September 30, 2022 September 30, 2021 September 30, 2022 September 30, 2021 Revenue $ 40,210 $ 41,481 $ 122,737 $ 107,887 Cost of revenue 25,144 26,581 80,126 66,080 Gross profit 15,066 14,900 42,611 41,807 Operating expenses Selling, general, and administrative 11,960 10,681 38,341 27,111 Depreciation and amortization 4,627 2,148 13,595 7,355 Restructuring 996 - 996 - Goodwill impairment 1,066,564 - 1,066,564 - Total operating expenses 1,084,147 12,829 1,119,496 34,466 Operating (loss) income (1,069,081 ) 2,071 (1,076,885 ) 7,341 Interest expense and other (income) expense Interest expense 2,406 4,376 5,738 8,800 Other expense 81 442 276 9,007 Other income (25,548 ) - (88,771 ) (3,215 ) Total interest expense and other (income) expense, net (23,061 ) 4,818 (82,757 ) 14,592 Net loss before income tax (1,046,020 ) (2,747 ) (994,128 ) (7,251 ) Income tax (benefit) expense 87 729 167 807 Net loss (1,046,107 ) (3,476 ) (994,295 ) (8,058 ) Weighted average Class A common shares outstanding Basic 62,816,174 55,348,018 Diluted 62,816,174 55,348,018 Q3 2022 Revenue by Product Line Reported Three Months Ended ($ in thousands) 9/30/2022 % Revenue 9/30/2021 % Revenue % Change Revenue By Product Line Additive manufacturing $3,154 7.8% $4,480 10.8% -29.6% Injection molding $5,984 14.9% $7,812 18.8% -23.4% CNC machining $15,530 38.6% $14,160 34.1% 9.7% Precision sheet metal $13,719 34.1% $13,284 32.0% 3.3% Other revenue $1,823 4.5% $1,745 4.2% 4.5% Total $40,210 100% $41,481 100% -3.1% First Nine Months 2022 Revenue by Product Line Reported Nine Months Ended ($ in thousands) 9/30/2022 % Revenue 9/30/2021 % Revenue % Change Revenue By Product Line Additive manufacturing $11,713 9.5% $13,322 12.3% -12.1% Injection molding $19,892 16.2% $20,941 19.4% -5.0% CNC machining $43,441 35.4% $30,063 27.9% 44.5% Precision sheet metal $43,153 35.2% $38,494 35.7% 12.1% Other revenue $4,538 3.7% $5,067 4.7% -10.4% Total $122,737 100% $107,887 100% 13.8% Consolidated Balance Sheets ($ in thousands) Period Ended September 30, 2022 December 31, 2021 Assets (unaudited) Current assets Cash $ 8,004 $ 20,357 Accounts receivable, net 27,237 25,367 Inventory 15,831 13,165 Prepaid expenses and other current assets 3,170 1,836 Total current assets 54,242 60,725 Property and equipment, net 49,197 44,527 Right-of-use operating lease assets, net 10,774 - Right-of-use financing lease assets, net 2,308 - Intangible assets, net 255,947 269,622 Goodwill 121,779 1,189,464 Other non-current assets 1,415 2,036 Total assets $ 495,662 $ 1,566,374 Liabilities and Shareholders’ Equity Current liabilities Accounts payable $ 11,779 $ 9,409 Accrued expenses 8,162 5,957 Current operating lease liability 2,164 - Current financing lease liability 195 - Contingent consideration 700 2,748 Current portion of debt 31,955 29,697 Other current liabilities 2,037 2,058 Total current liabilities 56,992 49,869 Long-term debt, net 116,187 120,491 Fathom earnout shares liability 11,910 64,300 Sponsor earnout shares liability 1,790 9,380 Warrant liability 5,900 33,900 Payable to related parties pursuant to the tax receivable agreement (includes $4,400 and $4,600 at fair value, respectively) 26,100 4,600 Noncurrent contingent consideration - 850 Noncurrent operating lease liability 9,041 - Noncurrent financing lease liability 2,176 - Deferred tax liability - 17,570 Other noncurrent liabilities - 4,655 Total liabilities 230,096 305,615 Commitments and Contingencies: Redeemable non-controlling interest in Fathom Holdco, LLC. 161,407 841,982 Shareholders' Equity: Class A common stock, $0.0001 par value; 300,000,000 shares authorized; 65,529,753 issued and outstanding as of September 30, 2022 and 50,785,656 issued and outstanding as of December 31, 2021 6 5 Class B common stock, $0.0001 par value; 180,000,000 shares authorized; 70,153,051 shares issued and outstanding as of September 30, 2022 and 84,294,971 shares issued and outstanding as of December 31, 2021 7 8 Class C common stock, $.0001 par value; 10,000,000 shares authorized; 0 shares issued and outstanding as of September 30, 2022 and December 31, 2021 - - Preferred Stock, $.0001 par value; 10,000,000 shares authorized; 0 shares issued and outstanding as of September 30, 2022 and December 31, 2021 - - Additional paid-in-capital 584,313 466,345 Accumulated other comprehensive loss - Accumulated deficit (480,167 ) (47,581 ) Shareholders’ equity attributable to Fathom Digital Manufacturing Corporation 104,159 418,777 Total Liabilities, Shareholders’ Equity, and Redeemable Non-Controlling Interest $ 495,662 $ 1,566,374 ($ in thousands) Three Months Ended Nine Months Ended September 30, 2022 September 30, 2021 September 30, 2022 September 30, 2021 Net loss $ (1,046,107) $ (3,476) $ (994,295) $ (8,058) Acquisition expenses(1) - - - 4,045 Stock compensation 1,762 - 5,687 - Inventory step-up amortization - (277) 3,241 - Goodwill impairment 1,066,564 1,066,564 Restructuring 996 - 996 - Change in fair value of warrant liability(2) (7,400) - (28,000) - Change in fair value of earnout shares liability(2) (18,080) - (59,980) - Change in fair value of tax receivable agreement2) - - (200) - Integration, non-recurring, non-operating, cash, and non-cash costs(3) 492 2,679 3,443 5,309 Adjusted net income (loss) $ (1,773) $ (1,074) $ (2,544) $ 1,296 1 Represents expenses incurred related to business acquisitions; 2 Represents the impacts from the change in fair value related to both the earnout shares liability, the warrant liability and the tax receivable agreement associated with the business combination completed on December 23, 2021; 3 Represents adjustments for other integration, non-recurring, non-operating, cash, and non-cash costs related primarily to integration costs for new acquisitions, severance, and management fees paid to our principal owner. Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA ($ in thousands) Three Months Ended Nine Months Ended September 30, 2022 September 30, 2021 September 30, 2022 September 30, 2021 Net loss $ (1,046,107) $ (3,476) $ (994,295) $ (8,058) Depreciation and amortization 6,335 4,381 18,539 12,006 Interest expense, net 2,406 4,376 5,738 8,800 Income tax expense 88 729 167 807 Acquisition expenses(1) - - - 4,045 Inventory step-up amortization - (277) 3,241 - Stock compensation 1,762 - 5,687 - Goodwill impairment 1,066,564 - 1,066,564 - Restructuring 996 - 996 - Change in fair value of warrant liability(2) (7,400) - (28,000) - Change in fair value of earnout shares liability(2) (18,080) - (59,980) - Change in fair value of tax receivable agreement(2) - - (200) - Contingent consideration(3) - 235 - (1,120) Loss on extinguishment of debt(4) - - - 2,031 Integration, non-recurring, non-operating, cash, and non-cash costs(5) 492 2,679 3,443 5,309 Adjusted EBITDA $ 7,056 $ 8,647 $ 21,900 $ 23,820 1 Represents expenses incurred related to business acquisitions; 2 Represents the impacts from the change in fair value related to both the earnout shares liability, the warrant liability and the tax receivable agreement associated with the business combination completed on December 23, 2021; 3 Represents the change in fair value of contingent consideration payable to former owners of acquired businesses; 4 Represents amounts paid to refinance debt in April of 2021; 5 Represents adjustments for other integration, non-recurring, non-operating, cash, and non-cash costs related primarily to integration costs for new acquisitions, severance, and management fees paid to our principal owner.

Fathom Digital Manufacturing Inc. (FATH) CEO Ryan Martin on Q2 2022 Results - Earnings Call Transcript

Fathom Digital Manufacturing Inc. (NYSE:FATH ) Q2 2022 Earnings Conference Call August 15, 2022 8:30 AM ET Company Participants Michael Cimini - Director of Investor Relations Ryan Martin - Chief Executive Officer Mark Frost - Chief Financial Officer Conference Call Participants Jim Ricchiuti - Needham & Co. Noelle Dilts - Stifel Wamsi Mohan - Bank of America Troy Jensen - Lake Street Capital Markets Operator Hello. My name is Charlie and I'll be the operator for this call this morning.

Fathom Digital Manufacturing Reports Second Quarter 2022 Financial Results

HARTLAND, Wis.--(BUSINESS WIRE)--Fathom Digital Manufacturing Corp. (NYSE: FATH), an industry leader in on-demand digital manufacturing services, today announced financial results for the three and six months ended June 30, 2022. Three Months Ended Six Months Ended ($ in thousands) 6/30/2022 6/30/2021 6/30/2022 6/30/2021 Revenue $41,985 $35,872 $82,526 $66,406 Net income (loss) $33,979 $(4,082) $51,813 $(4,582) Adjusted net income (loss)1 $1,192 $310 $(769) $2,370 Adjusted EBITDA1 $8,668 $7,464 $14,846 $15,173 Adjusted EBITDA margin1 20.6% 20.8% 18.0% 22.8% 1 See “Non-GAAP Financial Information.” Reconciliations of non-GAAP financial measures are included in the appendix. “In the second quarter, we built upon our proven history of growth and profitability as revenue rose 17% from continued growth in our strategic accounts and previous M&A activity while adjusted EBITDA increased 16.1% to $8.7 million, representing a leading industry margin,” said Ryan Martin, Fathom Chief Executive Officer. “We continue to benefit from our comprehensive manufacturing services by providing a diverse group of enterprise-level customers with timely, value-added solutions across both additive manufacturing and traditional manufacturing technologies. Our focus remains on investing in new technologies and expanding our breadth of leading offerings as we continue to take advantage of the positive long-term fundamentals of our business.” Mr. Martin added, “For the full year, we have realigned our expectations with the current macro environment given the downshift in the broader economy. We continue to focus on strengthening our commercial team and expect to be in a strong position to achieve our go-forward growth target.” Summary of Financial Results Revenue for the second quarter of 2022 was $42.0 million compared to $35.9 million in the second quarter of 2021, an increase of $6.1 million, or 17.0%, of which approximately $3.6 million was organic and $2.5 was from acquisitions completed in Q2 2021. For the six months ended June 30, 2022, revenue increased 24.3% to $82.5 million from $66.4 million for the six months ended June 30, 2021. Gross profit for the second quarter of 2022 totaled $15.5 million, or 37.0% of revenue, compared to $13.5 million, or 37.6% of revenue, in the second quarter of 2021. Gross profit for the six months ended June 30, 2022 was $27.5 million, or 33.4% of revenue, which includes approximately $3.7 million in non-cash purchase accounting adjustments, compared to $26.9 million, or 40.5% of revenue, for the same period in 2021. Net income for the second quarter of 2022 was $34.0 million compared to a net loss of $4.1 million in the second quarter of 2021. Excluding acquisition costs, stock compensation expense, the revaluation of Fathom warrants and earnout shares, and other costs, Fathom reported adjusted net income in the second quarter of 2022 of $1.2 million compared to adjusted net income of $0.3 million for the same period in 2021. Net income for the six months ended June 30, 2022 was $51.8 million compared to a net loss of $4.6 million for the same period in 2021. For the six months ended June 30, 2022, the adjusted net loss was $0.8 million compared to adjusted net income of $2.4 million for the same period in 2021. Adjusted EBITDA for the second quarter of 2022 increased to $8.7 million from $7.5 million for the same period in 2021 primarily due to higher volumes partially offset by the incurrence of public company expenses totaling approximately $2.4 million. The Adjusted EBITDA margin in the quarter was 20.6% compared to 20.8% in the second quarter of 2021. For the six months ended June 30, 2022, Adjusted EBITDA and Adjusted EBITDA margin were $14.8 million and 18.0%, respectively, compared to $15.2 million and 22.8%, respectively, for the same period in 2021. Revised 2022 Outlook For 2022, Fathom currently expects year-over-year revenue growth of approximately 8% to 12% for a range between $165 million and $171 million. Fathom also expects Adjusted EBITDA to range between $32 million and $36 million, representing year-over-year growth of approximately (7%) to 5% and an implied Adjusted EBITDA margin of 19.4% to 21.1%. Fathom’s current guidance, as of August 15, 2022, excludes the impact of any potential new acquisitions. Conference Call Fathom will host a conference call on Monday, August 15, 2022, at 8:30 am Eastern Time. The dial-in number for callers in the U.S. is +1-844-200-6205 and the dial-in number for international callers is +1-929-526-1599. The access code for all callers is 489270. The conference call will be broadcast live over the Internet and include a slide presentation. To access the webcast and supporting materials, please visit the investor relations section of Fathom’s website at https://investors.fathommfg.com. A replay of the conference call can be accessed through August 22, 2022, by dialing +1-866-813-9403 (US) or +1-226-828-7578 (international), and then entering the access code 896018. The webcast will also be archived on Fathom’s website. About Fathom Digital Manufacturing Fathom is one of the largest on-demand digital manufacturing platforms in North America, serving the comprehensive product development and low- to mid-volume manufacturing needs of some of the largest and most innovative companies in the world. With more than 25 unique manufacturing processes and a national footprint with nearly 450,000 square feet of manufacturing capacity across 12 facilities, Fathom seamlessly blends in-house capabilities across plastic and metal additive technologies, CNC machining, injection molding and tooling, sheet metal fabrication, and design and engineering. With more than 35 years of industry experience, Fathom is at the forefront of the Industry 4.0 digital manufacturing revolution, serving clients in the technology, defense, aerospace, medical, automotive and IOT sectors. To learn more, visit https://fathommfg.com/. Forward-Looking Statements Certain statements made in this press release are “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Words such as “estimates,” “projects,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “would,” “should,” “future,” “propose,” “target,” “goal,” “objective,” “outlook” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside the control of Fathom Digital Manufacturing Corporation (“Fathom”) that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include: the inability to recognize the anticipated benefits of our business combination with Altimar Acquisition Corp. II; changes in general economic conditions, including as a result of the COVID-19 pandemic; the outcome of litigation related to or arising out of the business combination, or any adverse developments therein or delays or costs resulting therefrom; the ability to meet the New York Stock Exchange’s listing standards following the consummation of the business combination; costs related to the business combination and additional factors discussed in Fathom’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the Securities and Exchange Commission (the “SEC”) on April 8, 2022 as well as Fathom’s other filings with the SEC. If any of the risks described above materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by our forward-looking statements. There may be additional risks that Fathom does not presently know or that Fathom currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Fathom’s expectations, plans or forecasts of future events and views as of the date of this press release. These forward-looking statements should not be relied upon as representing Fathom’s assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements. Fathom undertakes no obligation to update or revise any forward-looking statements made by management or on its behalf, including with respect to the revised financial guidance for full year 2022 contained herein, whether as a result of future developments, subsequent events or circumstances or otherwise, except as required by law. Non-GAAP Financial Information This press release includes Adjusted Net Income, Adjusted EBITDA and Adjusted EBITDA margin, which are non-GAAP financial measures that we use to supplement our results presented in accordance with U.S. GAAP. We believe Adjusted Net Income, Adjusted EBITDA and Adjusted EBITDA margin are useful in evaluating our operating performance, as they are similar to measures reported by our public competitors and regularly used by security analysts, institutional investors and other interested parties in analyzing operating performance and prospects. Adjusted Net Income, Adjusted EBITDA and Adjusted EBITDA margin are not intended to be a substitute for any U.S. GAAP financial measure and, as calculated, may not be comparable to other similarly titled measures of performance of other companies in other industries or within the same industry. We define and calculate Adjusted Net Income as net income (loss) before the impact of any increase or decrease in the estimated fair value of the company’s warrants or earnout shares. We define and calculate Adjusted EBITDA as net income (loss) before the impact of interest income or expense, income tax expense and depreciation and amortization, and further adjusted for the following items: stock-based compensation, transaction-related costs, and certain other non-cash and non-core items, as described in the reconciliation included in the appendix to this press release. Adjusted EBITDA excludes certain expenses that are required in accordance with U.S. GAAP because they are non-recurring (for example, in the case of transaction-related costs), non-cash (for example, in the case of depreciation, amortization and stock-based compensation) or are not related to our underlying business performance (for example, in the case of interest income and expense). Adjusted EBITDA margin represents Adjusted EBITDA divided by total revenue. We include these non-GAAP financial measures because they are used by management to evaluate Fathom’s core operating performance and trends and to make strategic decisions regarding the allocation of capital and new investments. Information reconciling forward-looking Adjusted EBITDA to GAAP financial measures is unavailable to Fathom without unreasonable effort. The company is not able to provide reconciliations of forward-looking Adjusted EBITDA to GAAP financial measures because certain items required for such reconciliations are outside of Fathom's control and/or cannot be reasonably predicted, such as the provision for income taxes. Preparation of such reconciliations would require a forward-looking balance sheet, statement of income and statement of cash flow, prepared in accordance with GAAP, and such forward-looking financial statements are unavailable to Fathom without unreasonable effort. Fathom provides a range for its Adjusted EBITDA forecast that it believes will be achieved, however it cannot accurately predict all the components of the Adjusted EBITDA calculation. Fathom provides an Adjusted EBITDA forecast because it believes that Adjusted EBITDA, when viewed with the company's results under GAAP, provides useful information for the reasons noted above. However, Adjusted EBITDA is not a measure of financial performance or liquidity under GAAP and, accordingly, should not be considered as an alternative to net income or cash flow from operating activities as an indicator of operating performance or liquidity. Consolidated Statements of Comprehensive Income (Loss) (Unaudited) ($ in thousands) Three months ended Six months ended June 30, 2022 (Successor) June 30, 2021 (Predecessor) June 30, 2022 (Successor) June 30, 2021 (Predecessor) Revenue $ 41,985 $ 35,872 $ 82,526 $ 66,406 Cost of revenue 26,437 22,376 54,981 39,499 Gross profit 15,548 13,496 27,545 26,907 Operating expenses Selling, general, and administrative 11,617 8,760 26,381 16,430 Depreciation and amortization 4,452 2,535 8,968 5,207 Total operating expenses 16,069 11,295 35,349 21,637 Operating (loss) income (521 ) 2,201 (7,804 ) 5,270 Interest expense and other (income) expense Interest expense 1,858 2,310 3,332 4,424 Other expense 129 7,110 195 8,650 Other income (36,108 ) (3,206 ) (63,223 ) (3,300 ) Total interest expense and other (income) expense, net (34,121 ) 6,214 (59,696 ) 9,774 Net income (loss) before income tax $ 33,601 $ (4,013 ) $ 51,892 $ (4,504 ) Income tax (benefit) expense (378 ) 69 79 78 Net income (loss) $ 33,979 $ (4,082 ) $ 51,813 $ (4,582 ) Net loss attributable to Fathom OpCo non-controlling interest (442 ) - (5,702 ) - Net income attributable to controlling interest 34,421 (4,082 ) 57,515 (4,582 ) Comprehensive income (loss): Loss from foreign currency translation adjustments - 2 (107 ) (105 ) Comprehensive income (loss), net of tax $ 34,421 $ (4,080 ) $ 57,408 $ (4,687 ) Weighted average Class A common shares outstanding Basic 52,259,885 51,530,961 Diluted 135,524,773 135,305,168 Q2 2022 Revenue by Product Line Reported Three Months Ended ($ in thousands) 6/30/2022 % Revenue 6/30/2021 % Revenue % Change Revenue By Product Line Additive manufacturing $4,410 10.5% $4,302 12.0% 2.5% Injection molding $7,093 16.9% $6,492 18.1% 9.3% CNC machining $14,584 34.7% $11,072 30.9% 31.7% Precision sheet metal $14,751 35.1% $12,093 33.7% 22.0% Other revenue $1,147 2.7% $1,913 5.3% -40.0% Total $41,985 100% $35,872 100% 17.0% First Half 2022 Revenue by Product Line Reported Six Months Ended ($ in thousands) 6/30/2022 % Revenue 6/30/2021 % Revenue % Change Revenue By Product Line Additive manufacturing $8,559 10.4% $8,842 13.3% -3.2% Injection molding $13,908 16.8% $13,129 19.8% 5.9% CNC machining $27,910 33.8% $15,903 23.9% 75.5% Precision sheet metal $29,434 35.7% $25,210 38.0% 16.8% Other revenue $2,715 3.3% $3,322 5.0% -18.3% Total $82,526 100% $66,406 100% 24.3% Consolidated Balance Sheets ($ in thousands) Period Ended June 30, 2022 December 31, 2021 Assets (unaudited) Current assets Cash $ 11,118 $ 20,357 Accounts receivable, net 26,402 25,367 Inventory 14,100 13,165 Prepaid expenses and other current assets 3,802 1,836 Total current assets 55,422 60,725 Property and equipment, net 46,908 44,527 Right-of-use operating lease assets, net 8,081 - Right-of-use financing lease assets, net 2,363 - Intangible assets, net 260,483 269,622 Goodwill 1,188,441 1,189,464 Other non-current assets 1,415 2,036 Total assets $ 1,563,113 $ 1,566,374 Liabilities and Shareholders’ Equity Current liabilities Accounts payable $ 11,468 $ 9,409 Accrued expenses 7,254 5,957 Current operating lease liability 2,976 - Current financing lease liability 190 - Contingent consideration 700 2,748 Current portion of debt 31,179 29,697 Other current liabilities 3,767 2,058 Total current liabilities 57,534 49,869 Long-term debt, net 117,677 120,491 Fathom earnout shares liability 27,690 64,300 Sponsor earnout shares liability 4,090 9,380 Warrant liability 13,300 33,900 Noncurrent contingent consideration - 850 Noncurrent operating lease liability 5,160 - Noncurrent financing lease liability 2,227 - Deferred tax liability 12,335 17,570 Other noncurrent liabilities - 4,655 Payable to related parties pursuant to the tax receivable agreement (includes $4,440 and $4,600 at fair value, respectively) 9,400 4,600 Total liabilities 249,413 305,615 Commitments and Contingencies: Redeemable non-controlling interest in Fathom OpCo 749,615 841,982 Shareholders' Equity: Class A common stock, $0.0001 par value; 300,000,000 shares authorized; 61,596,519 issued and outstanding as of June 30, 2022 and 50,785,656 issued and outstanding as of December 31, 2021 6 5 Class B common stock, $0.0001 par value; 180,000,000 shares authorized; 74,014,640 shares issued and outstanding as of June 30, 2022 and 84,294,971 shares issued and outstanding as of December 31, 2021 7 8 Class C common stock, $.0001 par value; 10,000,000 shares authorized; 0 shares issued and outstanding as of June 30, 2022 and December 31, 2021 - - Preferred Stock, $.0001 par value; 10,000,000 shares authorized; 0 shares issued and outstanding as of June 30, 2022 and December 31, 2021 - - Treasury stock, at cost; 301,302 and 0 shares as of June 30, 2022 and December 31, 2021, respectively (2,258 ) - Additional paid-in-capital 556,417 466,345 Accumulated other comprehensive loss - Retained earnings (Accumulated deficit) 9,913 (47,581 ) Shareholders’ equity attributable to Fathom Digital Manufacturing Corporation 564,085 418,777 Total Liabilities, Shareholders’ Equity, and Redeemable Non-Controlling Interest $ 1,563,113 $ 1,566,374 Reconciliation of GAAP Net Income (Loss) to Adjusted Net Income (Loss) ($ in thousands) Q2 2022 Q2 2021 1H 2022 1H 2021 Net income (loss) $33,979 ($4,082) $51,813 ($4,582) Acquisition expenses1 - 2,876 - 4,045 Stock compensation 1,796 - 3,926 - Inventory step-up amortization - - 3,241 277 Change in fair value of warrant liability2 (12,500) - (20,600) - Change in fair value of earnout share liability2 (22,930) - (41,900) - Change in fair value of tax receivable agreement (TRA) (200) - (200) - Integration, non-recurring, non-operating, cash, and non-cash costs3 1,047 1,516 2,951 2,630 Adjusted net income (loss) $1,192 $310 ($769) $2,370 1 Represents expenses incurred related to business acquisitions; 2 Represents the impacts from the change in fair value related to both the earnout share liability and the warrant liability associated with the business combination completed on December 23, 2021; 3 Represents adjustments for other integration, non-recurring, non-operating, cash, and non-cash costs related primarily to integration costs for new acquisitions, severance, and management fees paid to our principal owner. Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA ($ in thousands) Q2 2022 Q2 2021 1H 2022 1H 2021 Net income (loss) $33,979 ($4,082) $51,813 ($4,582) Depreciation and amortization 5,996 4,099 12,204 7,625 Interest expense, net 1,858 2,310 3,332 4,424 Income tax expense (378) 69 79 78 Acquisition expenses1 - 2,876 - 4,045 Inventory step-up amortization - - 3,241 277 Stock compensation 1,796 - 3,926 - Change in fair value of warrant liability2 (12,500) - (20,600) - Change in fair value of earnout share liability2 (22,930) - (41,900) - Change in fair value of tax receivable agreement (TRA) (200) - (200) - Contingent consideration3 - (1,355) - (1,355) Loss on extinguishment of debt4 - 2,031 - 2,031 Integration, non-recurring, non-operating, cash, and non-cash costs5 1,047 1,516 2,951 2,630 Adjusted EBITDA $8,668 $7,464 $14,846 $15,173 1 Represents expenses incurred related to business acquisitions; 2 Represents the impacts from the change in fair value related to both the earnout share liability and the warrant liability associated with the business combination completed on December 23, 2021; 3 Represents the change in fair value of contingent consideration payable to former owners of acquired businesses; 4 Represents amounts paid to refinance debt in April of 2021; 5 Represents adjustments for other integration, non-recurring, non-operating, cash, and non-cash costs related primarily to integration costs for new acquisitions, severance, and management fees paid to our principal owner.

Fathom Digital Manufacturing to Hold Second Quarter 2022 Conference Call on Monday, August 15, 2022

HARTLAND, Wis.--(BUSINESS WIRE)--Fathom Digital Manufacturing Corp. (NYSE: FATH), an industry leader in on-demand digital manufacturing services, today announced that it plans to issue financial results for the second quarter ended June 30, 2022 on Monday, August 15, 2022 before the open of market trading. Fathom will also hold a conference call the same day at 8:30 am Eastern Time. To participate on the conference call, please dial +1-844-200-6205 (US) or +1-929-526-1599 (international) and us

Fathom Digital Manufacturing to Present at the Stifel 2022 Cross Sector Insight Conference

HARTLAND, Wis.--(BUSINESS WIRE)--Fathom Digital Manufacturing Corp. (NYSE: FATH), an industry leader in on-demand digital manufacturing services, today announced that Ryan Martin, Chief Executive Officer, and Mark Frost, Chief Financial Officer, are scheduled to present at the Stifel 2022 Cross Sector Insight Conference in Boston on Tuesday, June 7, 2022, at 1:50 pm Eastern Time. The presentation will be broadcast via webcast and can be accessed through the Investor Relations section of Fathom'

Fathom Digital Manufacturing Inc. (FATH) CEO Ryan Martin on Q1 2022 Results - Earnings Call Transcript

Fathom Digital Manufacturing Inc. (NYSE:FATH ) Q1 2022 Earnings Conference Call May 16, 2022 8:30 AM ET Company Participants Michael Cimini - Director of Investor Relations Ryan Martin - Chief Executive Officer Conference Call Participants Operator Hello and welcome everyone to Fathom Digital Manufacturing Earnings Conference Call. This call is being recorded and a replay will be available later today.

Fathom Digital Manufacturing Reports First Quarter 2022 Financial Results