Tesla (TSLA) Stock

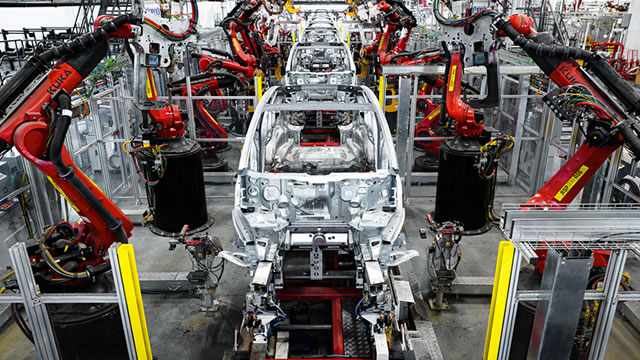

Company Profile

Price: $352.56

Market Cap: $1.13T

Exchange: NASDAQ

CEO: Mr. Elon R. Musk

Sector: Consumer Cyclical

Industry: Auto - Manufacturers

Employees: 140.47K

Headquarters: Austin, TX

Website: Tesla

Business Summary

Tesla, Inc. designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally. It operates in two segments, Automotive, and Energy Generation and Storage. The Automotive segment offers electric vehicles, as well as sells automotive regulatory credits; and non-warranty after-sales vehicle, used vehicles, retail merchandise, and vehicle insurance services. This segment also provides sedans and sport utility vehicles through direct and used vehicle sales, a network of Tesla Superchargers, and in-app upgrades; purchase financing and leasing services; services for electric vehicles through its company-owned service locations and Tesla mobile service technicians; and vehicle limited warranties and extended service plans. The Energy Generation and Storage segment engages in the design, manufacture, installation, sale, and leasing of solar energy generation and energy storage products, and related services to residential, commercial, and industrial customers and utilities through its website, stores, and galleries, as well as through a network of channel partners; and provision of service and repairs to its energy product customers, including under warranty, as well as various financing options to its solar customers. The company was formerly known as Tesla Motors, Inc. and changed its name to Tesla, Inc. in February 2017. Tesla, Inc. was incorporated in 2003 and is headquartered in Austin, Texas.

Tesla Chart

Tesla News

Tesla must face part of 'phantom braking' lawsuit, US judge rules

Elon Musk's electric vehicle maker Tesla failed to persuade a U.S. judge to throw out a consumer lawsuit accusing it of failing to warn buyers about an alleged defect that can cause the cars to brake automatically when there is no actual collision risk.

-

reuters.com

2024-11-22

Bezos dismisses Musk's claim he predicted a Trump election loss

Amazon.com Inc (NASDAQ:AMZN) founder Jeff Bezos has denied claims from Tesla Inc (NASDAQ:TSLA) CEO Elon Musk that he believed President-Elect Donald Trump would lose the election and he told people to sell their shares in Musk-owned companies before the vote. Elon wrote in a post on X, his social media platform: “Just learned tonight at Mar-a-Lago that Jeff Bezos was telling everyone that @realDonaldTrump would lose for sure, so they should sell all their Tesla and SpaceX stock,” followed by a laughing emoji.

-

proactiveinvestors.com

2024-11-22

Tesla Investors Continue to Profit From the Trump Trade

Tesla Inc. NASDAQ: TSLA stock has been up 56.2% since Donald Trump was elected president of the United States. But the recent move of 6.6% the week of November 18, 2024, has investors thinking that the stock may be going to $400 or even higher.

-

marketbeat.com

2024-11-22

Tesla Earnings

This section highlight's Tesla's earnings, including earnings call transcripts, earnings surprises, and key dates.

Tesla Earnings Call Transcripts

| Transcript | Quarter | Year | Date | Estimated EPS | Actual EPS |

|---|---|---|---|---|---|

| Read Transcript | Q3 | 2024 | 2024-10-23 | $0.58 | $0.72 |

| Read Transcript | Q2 | 2024 | 2024-07-24 | N/A | N/A |

| Read Transcript | Q1 | 2024 | 2024-04-23 | $0.51 | $0.45 |

| Read Transcript | Q4 | 2023 | 2024-01-24 | $0.75 | $0.71 |

| Read Transcript | Q3 | 2023 | 2023-10-18 | $0.72 | $0.66 |

| Read Transcript | Q2 | 2023 | 2023-07-19 | $0.82 | $0.91 |

| Read Transcript | Q1 | 2023 | 2023-04-19 | $0.85 | $0.85 |

| Read Transcript | Q4 | 2022 | 2023-01-25 | $1.13 | $1.19 |

| Read Transcript | Q3 | 2022 | 2022-10-19 | $0.99 | $1.05 |

| Read Transcript | Q2 | 2022 | 2022-07-20 | $0.60 | $0.76 |

| Read Transcript | Q1 | 2022 | 2022-04-20 | $0.75 | $1.07 |

Tesla Earnings Dates

When is the next earnings date for TSLA?

Date: 2025-01-22Status: Unconfirmed

Time of Day: After Market

Estimated EPS: $0.74

When was the last earnings date for TSLA?

Date: 2024-10-23Fiscal Date Ending: 2024-09-30

EPS: $0.72

Estimated EPS: $0.58

Revenue: $25.18B

Estimated Revenue: $25.47B

Upcoming TSLA Earnings

| Date | Estimated EPS | Time of Day | Status |

|---|---|---|---|

| 2025-01-22 | $0.74 | After Market | Unconfirmed |

| 2025-04-23 | N/A | After Market | Unconfirmed |

| 2025-07-21 | N/A | After Market | Unconfirmed |

| 2025-10-21 | N/A | After Market | Unconfirmed |

Financial Statements

This section provides financial statements for Teslaincluding income statements, balance sheets, and cash flow statements, both annually and quarterly.

Annual Income Statement

| Breakdown | 2019-12-31 | 2020-12-31 | 2021-12-31 | 2022-12-31 | 2023-12-31 |

|---|---|---|---|---|---|

| Revenue | $24.58B | $31.54B | $53.82B | $81.46B | $96.77B |

| Cost of Revenue | $20.51B | $24.91B | $40.22B | $60.61B | $79.11B |

| Gross Profit | $4.07B | $6.63B | $13.61B | $20.85B | $17.66B |

| Gross Profit Ratio | 16.56% | 21.02% | 25.28% | 25.60% | 18.25% |

| Research and Development Expenses | $1.34B | $1.49B | $2.59B | $3.08B | $3.97B |

| General and Administrative Expenses | $- | $- | $- | $- | $- |

| Selling and Marketing Expenses | $- | $- | $- | $- | $- |

| Selling General and Administrative Expenses | $2.65B | $3.15B | $4.52B | $3.95B | $4.80B |

| Other Expenses | $- | $- | $- | $- | $- |

| Operating Expenses | $3.99B | $4.64B | $7.11B | $7.02B | $8.77B |

| Cost and Expenses | $24.50B | $29.54B | $47.33B | $67.63B | $87.88B |

| Interest Income | $44.00M | $30.00M | $56.00M | $297.00M | $1.07B |

| Interest Expense | $685.00M | $748.00M | $371.00M | $191.00M | $156.00M |

| Depreciation and Amortization | $2.15B | $2.32B | $2.91B | $3.75B | $4.67B |

| EBITDA | $2.17B | $4.22B | $9.62B | $17.40B | $14.80B |

| EBITDA Ratio | 8.84% | 13.39% | 17.53% | 21.36% | 15.29% |

| Operating Income | $69.00M | $-1.99B | $6.52B | $13.66B | $8.89B |

| Operating Income Ratio | 0.28% | -6.32% | 12.12% | 16.76% | 9.19% |

| Total Other Income Expenses Net | $-734.00M | $-840.00M | $-180.00M | $63.00M | $1.08B |

| Income Before Tax | $-665.00M | $1.15B | $6.34B | $13.72B | $9.97B |

| Income Before Tax Ratio | -2.71% | 3.66% | 11.78% | 16.84% | 10.31% |

| Income Tax Expense | $110.00M | $292.00M | $699.00M | $1.13B | $-5.00B |

| Net Income | $-862.00M | $721.00M | $5.52B | $12.58B | $15.00B |

| Net Income Ratio | -3.51% | 2.29% | 10.26% | 15.45% | 15.50% |

| EPS | $-0.33 | $0.25 | $1.87 | $4.02 | $4.73 |

| EPS Diluted | $-0.33 | $0.21 | $1.63 | $3.62 | $4.30 |

| Weighted Average Shares Outstanding | 2.65B | 2.88B | 2.96B | 3.13B | 3.17B |

| Weighted Average Shares Outstanding Diluted | 2.65B | 2.88B | 3.39B | 3.48B | 3.48B |

| SEC Filing | Source | Source | Source | Source | Source |

Quarterly Income Statement

| Breakdown | 2019-12-31 | 2020-03-31 | 2020-06-30 | 2020-09-30 | 2020-12-31 | 2021-03-31 | 2021-06-30 | 2021-09-30 | 2021-12-31 | 2022-03-31 | 2022-06-30 | 2022-09-30 | 2022-12-31 | 2023-03-31 | 2023-06-30 | 2023-09-30 | 2023-12-31 | 2024-03-31 | 2024-06-30 | 2024-09-30 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | $7.38B | $5.99B | $6.04B | $8.77B | $10.74B | $10.39B | $11.96B | $13.76B | $17.72B | $18.76B | $16.93B | $21.45B | $24.32B | $23.33B | $24.93B | $23.35B | $25.17B | $21.30B | $25.50B | $25.18B |

| Cost of Revenue | $5.99B | $4.75B | $4.77B | $6.71B | $8.68B | $8.17B | $9.07B | $10.10B | $12.87B | $13.30B | $12.70B | $16.07B | $18.54B | $18.82B | $20.39B | $19.17B | $20.73B | $17.61B | $20.92B | $20.18B |

| Gross Profit | $1.39B | $1.23B | $1.27B | $2.06B | $2.07B | $2.21B | $2.88B | $3.66B | $4.85B | $5.46B | $4.23B | $5.38B | $5.78B | $4.51B | $4.53B | $4.18B | $4.44B | $3.70B | $4.58B | $5.00B |

| Gross Profit Ratio | 18.84% | 20.62% | 20.99% | 23.52% | 19.23% | 21.32% | 24.12% | 26.60% | 27.35% | 29.11% | 25.00% | 25.09% | 23.76% | 19.34% | 18.19% | 17.89% | 17.63% | 17.35% | 17.95% | 19.84% |

| Research and Development Expenses | $344.93M | $324.00M | $279.00M | $366.00M | $522.00M | $666.00M | $576.00M | $611.00M | $740.00M | $865.00M | $667.00M | $733.00M | $810.00M | $771.00M | $943.00M | $1.16B | $1.09B | $1.15B | $1.07B | $1.04B |

| General and Administrative Expenses | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- |

| Selling and Marketing Expenses | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- |

| Selling General and Administrative Expenses | $699.00M | $627.00M | $661.00M | $888.00M | $969.00M | $1.06B | $973.00M | $994.00M | $1.49B | $992.00M | $961.00M | $961.00M | $1.03B | $1.08B | $1.19B | $1.25B | $1.28B | $1.37B | $1.28B | $1.19B |

| Other Expenses | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- |

| Operating Expenses | $1.04B | $951.00M | $940.00M | $1.25B | $1.49B | $1.72B | $1.55B | $1.60B | $2.23B | $1.86B | $1.63B | $1.69B | $1.84B | $1.85B | $2.13B | $2.41B | $2.37B | $2.52B | $2.35B | $2.23B |

| Cost and Expenses | $7.04B | $5.70B | $5.71B | $7.96B | $10.17B | $9.90B | $10.62B | $11.70B | $15.11B | $15.15B | $14.33B | $17.77B | $20.38B | $20.66B | $22.53B | $21.59B | $23.10B | $20.13B | $23.27B | $22.41B |

| Interest Income | $10.00M | $10.00M | $8.00M | $6.00M | $6.00M | $10.00M | $11.00M | $10.00M | $25.00M | $28.00M | $26.00M | $86.00M | $157.00M | $213.00M | $238.00M | $282.00M | $333.00M | $350.00M | $348.00M | $429.00M |

| Interest Expense | $170.00M | $169.00M | $170.00M | $163.00M | $246.00M | $99.00M | $75.00M | $126.00M | $71.00M | $61.00M | $44.00M | $53.00M | $33.00M | $29.00M | $28.00M | $38.00M | $61.00M | $76.00M | $86.00M | $92.00M |

| Depreciation and Amortization | $577.00M | $553.00M | $567.00M | $584.00M | $618.00M | $621.00M | $681.00M | $761.00M | $848.00M | $880.00M | $922.00M | $956.00M | $989.00M | $1.05B | $1.15B | $1.24B | $1.23B | $1.25B | $1.28B | $1.35B |

| EBITDA | $921.00M | $792.00M | $887.00M | $1.30B | $1.24B | $1.25B | $2.05B | $2.77B | $3.55B | $4.57B | $3.44B | $4.64B | $5.00B | $3.88B | $4.12B | $3.32B | $3.48B | $2.88B | $3.25B | $4.22B |

| EBITDA Ratio | 12.47% | 13.23% | 14.70% | 14.84% | 11.10% | 10.72% | 16.67% | 20.10% | 19.53% | 23.90% | 20.21% | 21.65% | 19.96% | 15.90% | 14.25% | 12.84% | 13.10% | 11.35% | 12.75% | 16.77% |

| Operating Income | $359.00M | $283.00M | $327.00M | $809.00M | $575.00M | $594.00M | $1.31B | $2.00B | $-10.43B | $3.60B | $2.46B | $3.69B | $3.90B | $2.66B | $2.40B | $1.76B | $2.06B | $1.17B | $1.60B | $2.72B |

| Operating Income Ratio | 4.86% | 4.73% | 5.42% | 9.22% | 5.35% | 5.72% | 10.97% | 14.57% | -58.88% | 19.21% | 14.55% | 17.19% | 16.04% | 11.42% | 9.62% | 7.55% | 8.20% | 5.50% | 6.29% | 10.79% |

| Total Other Income Expenses Net | $-185.00M | $-213.00M | $-177.00M | $-254.00M | $-196.00M | $-61.00M | $-19.00M | $-122.00M | $22.00M | $23.00M | $10.00M | $-52.00M | $82.00M | $136.00M | $538.00M | $281.00M | $127.00M | $382.00M | $282.00M | $67.00M |

| Income Before Tax | $174.00M | $70.00M | $150.00M | $555.00M | $379.00M | $533.00M | $1.29B | $1.88B | $2.63B | $3.63B | $2.47B | $3.64B | $3.98B | $2.80B | $2.94B | $2.04B | $2.19B | $1.55B | $1.89B | $2.78B |

| Income Before Tax Ratio | 2.36% | 1.17% | 2.49% | 6.33% | 3.53% | 5.13% | 10.81% | 13.68% | 14.87% | 19.33% | 14.61% | 16.95% | 16.38% | 12.00% | 11.78% | 8.76% | 8.71% | 7.29% | 7.40% | 11.06% |

| Income Tax Expense | $42.00M | $2.00M | $21.00M | $186.00M | $83.00M | $69.00M | $115.00M | $223.00M | $292.00M | $346.00M | $205.00M | $305.00M | $276.00M | $261.00M | $323.00M | $167.00M | $-5.75B | $409.00M | $393.00M | $601.00M |

| Net Income | $105.00M | $16.00M | $104.00M | $300.00M | $239.00M | $438.00M | $1.14B | $1.62B | $2.32B | $3.32B | $2.26B | $3.29B | $3.71B | $2.51B | $2.70B | $1.85B | $7.93B | $1.13B | $1.48B | $2.17B |

| Net Income Ratio | 1.42% | 0.27% | 1.72% | 3.42% | 2.22% | 4.22% | 9.55% | 11.76% | 13.10% | 17.69% | 13.34% | 15.34% | 15.27% | 10.77% | 10.84% | 7.94% | 31.51% | 5.30% | 5.80% | 8.61% |

| EPS | $0.04 | $0.01 | $0.04 | $0.11 | $0.09 | $0.15 | $0.39 | $0.54 | $0.76 | $1.07 | $0.73 | $1.05 | $1.18 | $0.80 | $0.85 | $0.58 | $2.49 | $0.37 | $0.46 | $0.68 |

| EPS Diluted | $0.04 | $0.01 | $0.03 | $0.09 | $0.08 | $0.13 | $0.34 | $0.48 | $0.68 | $0.95 | $0.65 | $0.95 | $1.07 | $0.73 | $0.78 | $0.53 | $2.27 | $0.34 | $0.42 | $0.62 |

| Weighted Average Shares Outstanding | 2.70B | 2.75B | 2.79B | 2.81B | 2.85B | 2.88B | 2.91B | 2.99B | 3.04B | 3.10B | 3.11B | 3.15B | 3.16B | 3.17B | 3.17B | 3.18B | 3.18B | 3.19B | 3.19B | 3.20B |

| Weighted Average Shares Outstanding Diluted | 2.81B | 2.98B | 3.10B | 3.31B | 3.37B | 3.40B | 3.36B | 3.37B | 4.30B | 3.47B | 3.46B | 3.47B | 3.47B | 3.47B | 3.48B | 3.49B | 3.49B | 3.48B | 3.48B | 3.50B |

| SEC Filing | Source | Source | Source | Source | Source | Source | Source | Source | Source | Source | Source | Source | Source | Source | Source | Source | Source | Source | Source | Source |

Annual Balance Sheet

| Breakdown | 2019-12-31 | 2020-12-31 | 2021-12-31 | 2022-12-31 | 2023-12-31 |

|---|---|---|---|---|---|

| Cash and Cash Equivalents | $6.27B | $19.38B | $17.58B | $16.25B | $16.40B |

| Short Term Investments | $- | $- | $131.00M | $5.93B | $12.70B |

| Cash and Short Term Investments | $6.27B | $19.38B | $17.71B | $22.18B | $29.09B |

| Net Receivables | $1.32B | $1.89B | $1.91B | $2.95B | $3.51B |

| Inventory | $3.55B | $4.10B | $5.76B | $12.84B | $13.63B |

| Other Current Assets | $959.00M | $1.35B | $1.72B | $2.94B | $3.39B |

| Total Current Assets | $12.10B | $26.72B | $27.10B | $40.92B | $49.62B |

| Property Plant Equipment Net | $20.20B | $23.38B | $31.17B | $36.63B | $45.12B |

| Goodwill | $198.00M | $207.00M | $200.00M | $194.00M | $253.00M |

| Intangible Assets | $339.00M | $313.00M | $1.52B | $399.00M | $362.00M |

| Goodwill and Intangible Assets | $537.00M | $520.00M | $1.72B | $593.00M | $615.00M |

| Long Term Investments | $- | $- | $- | $- | $- |

| Tax Assets | $- | $- | $- | $328.00M | $6.73B |

| Other Non-Current Assets | $1.47B | $1.54B | $2.14B | $3.87B | $4.53B |

| Total Non-Current Assets | $22.20B | $25.43B | $35.03B | $41.42B | $57.00B |

| Other Assets | $3.00M | $-3.00M | $4.00M | $- | $- |

| Total Assets | $34.31B | $52.15B | $62.13B | $82.34B | $106.62B |

| Account Payables | $3.77B | $6.05B | $10.03B | $15.26B | $14.43B |

| Short Term Debt | $2.01B | $2.42B | $1.96B | $1.99B | $3.04B |

| Tax Payables | $611.00M | $777.00M | $1.12B | $1.24B | $1.20B |

| Deferred Revenue | $1.89B | $2.21B | $2.37B | $2.81B | $3.74B |

| Other Current Liabilities | $2.38B | $2.79B | $4.23B | $5.42B | $6.33B |

| Total Current Liabilities | $10.67B | $14.25B | $19.70B | $26.71B | $28.75B |

| Long Term Debt | $12.59B | $10.86B | $6.92B | $3.76B | $6.53B |

| Deferred Revenue Non-Current | $1.21B | $1.28B | $2.05B | $2.80B | $3.25B |

| Deferred Tax Liabilities Non-Current | $66.00M | $151.00M | $24.00M | $82.00M | $- |

| Other Non-Current Liabilities | $1.67B | $1.93B | $1.85B | $3.08B | $4.48B |

| Total Non-Current Liabilities | $15.53B | $14.22B | $10.84B | $9.73B | $14.26B |

| Other Liabilities | $- | $- | $- | $- | $- |

| Total Liabilities | $26.20B | $28.47B | $30.55B | $36.44B | $43.01B |

| Preferred Stock | $- | $- | $- | $- | $- |

| Common Stock | $1.00M | $1.00M | $3.00M | $3.00M | $3.00M |

| Retained Earnings | $-6.08B | $-5.40B | $329.00M | $12.88B | $27.88B |

| Accumulated Other Comprehensive Income Loss | $-36.00M | $363.00M | $54.00M | $-361.00M | $-143.00M |

| Other Total Stockholders Equity | $12.74B | $27.26B | $29.80B | $32.18B | $34.89B |

| Total Stockholders Equity | $6.62B | $22.23B | $30.19B | $44.70B | $62.63B |

| Total Equity | $8.11B | $23.68B | $31.58B | $45.90B | $63.61B |

| Total Liabilities and Stockholders Equity | $34.31B | $52.15B | $62.13B | $82.34B | $106.62B |

| Minority Interest | $1.49B | $1.45B | $1.39B | $1.19B | $975.00M |

| Total Liabilities and Total Equity | $34.31B | $52.15B | $62.13B | $82.34B | $106.62B |

| Total Investments | $672.00M | $613.00M | $131.00M | $5.93B | $12.70B |

| Total Debt | $14.60B | $13.28B | $8.87B | $5.75B | $9.57B |

| Net Debt | $8.34B | $-6.11B | $-8.70B | $-10.51B | $-6.83B |

Quarterly Balance Sheet

| Breakdown | 2019-12-31 | 2020-03-31 | 2020-06-30 | 2020-09-30 | 2020-12-31 | 2021-03-31 | 2021-06-30 | 2021-09-30 | 2021-12-31 | 2022-03-31 | 2022-06-30 | 2022-09-30 | 2022-12-31 | 2023-03-31 | 2023-06-30 | 2023-09-30 | 2023-12-31 | 2024-03-31 | 2024-06-30 | 2024-09-30 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cash and Cash Equivalents | $6.27B | $8.08B | $8.62B | $14.53B | $19.38B | $17.14B | $16.23B | $16.07B | $17.58B | $17.50B | $18.32B | $19.53B | $16.25B | $16.05B | $15.30B | $15.93B | $16.40B | $11.80B | $14.63B | $18.11B |

| Short Term Investments | $- | $- | $- | $- | $- | $- | $- | $30.00M | $131.00M | $508.00M | $591.00M | $1.57B | $5.93B | $6.35B | $7.78B | $10.14B | $12.70B | $15.06B | $16.09B | $15.54B |

| Cash and Short Term Investments | $6.27B | $8.08B | $8.62B | $14.53B | $19.38B | $17.14B | $16.23B | $16.09B | $17.71B | $18.01B | $18.91B | $21.11B | $22.18B | $22.40B | $23.07B | $26.08B | $29.09B | $26.86B | $30.72B | $33.65B |

| Net Receivables | $1.32B | $1.27B | $1.49B | $1.76B | $1.89B | $1.89B | $2.13B | $1.96B | $1.91B | $2.31B | $2.08B | $2.19B | $2.95B | $2.99B | $3.45B | $2.52B | $3.51B | $3.89B | $3.74B | $3.31B |

| Inventory | $3.55B | $4.49B | $4.02B | $4.22B | $4.10B | $4.13B | $4.73B | $5.20B | $5.76B | $6.69B | $8.11B | $10.33B | $12.84B | $14.38B | $14.36B | $13.72B | $13.63B | $16.03B | $14.20B | $14.53B |

| Other Current Assets | $959.00M | $1.04B | $1.22B | $1.24B | $1.35B | $1.54B | $1.60B | $1.75B | $1.72B | $2.04B | $2.12B | $2.36B | $2.94B | $3.23B | $3.00B | $2.71B | $3.39B | $3.75B | $4.33B | $4.89B |

| Total Current Assets | $12.10B | $14.89B | $15.34B | $21.74B | $26.72B | $24.70B | $24.69B | $25.00B | $27.10B | $29.05B | $31.22B | $35.99B | $40.92B | $43.00B | $43.88B | $45.03B | $49.62B | $50.53B | $52.98B | $56.38B |

| Property Plant Equipment Net | $20.20B | $20.47B | $20.87B | $21.99B | $23.38B | $24.84B | $27.03B | $29.25B | $31.17B | $32.64B | $33.68B | $34.57B | $36.63B | $38.67B | $41.05B | $42.79B | $45.12B | $46.70B | $48.11B | $51.40B |

| Goodwill | $198.00M | $193.00M | $196.00M | $203.00M | $207.00M | $206.00M | $203.00M | $201.00M | $200.00M | $200.00M | $196.00M | $191.00M | $194.00M | $195.00M | $263.00M | $250.00M | $253.00M | $250.00M | $249.00M | $253.00M |

| Intangible Assets | $339.00M | $324.00M | $312.00M | $318.00M | $313.00M | $299.00M | $283.00M | $269.00M | $1.52B | $1.51B | $459.00M | $446.00M | $399.00M | $388.00M | $386.00M | $375.00M | $362.00M | $171.00M | $164.00M | $158.00M |

| Goodwill and Intangible Assets | $537.00M | $517.00M | $508.00M | $521.00M | $520.00M | $505.00M | $486.00M | $470.00M | $1.72B | $1.72B | $655.00M | $637.00M | $593.00M | $583.00M | $649.00M | $625.00M | $615.00M | $421.00M | $413.00M | $411.00M |

| Long Term Investments | $- | $- | $- | $- | $- | $1.33B | $1.31B | $1.26B | $- | $- | $- | $- | $- | $- | $- | $- | $- | $184.00M | $184.00M | $- |

| Tax Assets | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $328.00M | $- | $- | $- | $6.73B | $6.77B | $6.69B | $6.49B |

| Other Non-Current Assets | $1.47B | $1.37B | $1.42B | $1.44B | $1.54B | $1.59B | $1.63B | $1.85B | $2.14B | $2.63B | $2.95B | $3.24B | $3.87B | $4.58B | $5.03B | $5.50B | $4.53B | $4.62B | $4.46B | $5.17B |

| Total Non-Current Assets | $22.20B | $22.36B | $22.80B | $23.95B | $25.43B | $28.26B | $30.45B | $32.83B | $35.03B | $36.99B | $37.28B | $38.44B | $41.42B | $43.83B | $46.72B | $48.92B | $57.00B | $58.69B | $59.85B | $63.47B |

| Other Assets | $3.00M | $-2.00M | $2.00M | $-3.00M | $-3.00M | $4.00M | $3.00M | $- | $4.00M | $2.00M | $7.00M | $-6.00M | $- | $3.00M | $-5.00M | $-1.00M | $- | $- | $- | $- |

| Total Assets | $34.31B | $37.25B | $38.13B | $45.69B | $52.15B | $52.97B | $55.15B | $57.83B | $62.13B | $66.04B | $68.51B | $74.43B | $82.34B | $86.83B | $90.59B | $93.94B | $106.62B | $109.23B | $112.83B | $119.85B |

| Account Payables | $3.77B | $3.97B | $3.64B | $4.96B | $6.05B | $6.65B | $7.56B | $8.26B | $10.03B | $11.17B | $11.21B | $13.90B | $15.26B | $15.90B | $15.27B | $13.94B | $14.43B | $14.72B | $13.06B | $14.65B |

| Short Term Debt | $2.01B | $3.50B | $3.96B | $3.42B | $2.42B | $2.13B | $1.85B | $2.06B | $1.96B | $2.06B | $1.95B | $1.88B | $1.99B | $1.91B | $2.01B | $2.58B | $3.04B | $3.17B | $3.01B | $3.09B |

| Tax Payables | $611.00M | $399.00M | $484.00M | $635.00M | $777.00M | $828.00M | $834.00M | $1.08B | $1.12B | $1.27B | $1.04B | $1.11B | $1.24B | $1.37B | $1.24B | $1.09B | $1.20B | $1.19B | $1.10B | $1.26B |

| Deferred Revenue | $1.89B | $1.97B | $1.84B | $1.97B | $2.21B | $2.34B | $2.50B | $2.63B | $2.37B | $2.72B | $3.04B | $3.01B | $2.81B | $2.81B | $3.20B | $3.10B | $3.74B | $3.91B | $3.74B | $4.03B |

| Other Current Liabilities | $2.38B | $2.93B | $3.06B | $3.03B | $2.79B | $2.94B | $3.62B | $4.02B | $4.23B | $4.24B | $4.58B | $4.71B | $5.42B | $5.44B | $5.87B | $5.93B | $6.33B | $6.46B | $6.82B | $7.54B |

| Total Current Liabilities | $10.67B | $11.99B | $12.27B | $13.30B | $14.25B | $14.88B | $16.37B | $18.05B | $19.70B | $21.45B | $21.82B | $24.61B | $26.71B | $27.44B | $27.59B | $26.64B | $28.75B | $29.45B | $27.73B | $30.58B |

| Long Term Debt | $12.59B | $11.70B | $11.52B | $11.74B | $10.86B | $10.38B | $9.28B | $8.07B | $6.92B | $4.97B | $4.72B | $3.99B | $3.76B | $3.66B | $3.80B | $5.61B | $6.53B | $6.75B | $9.50B | $9.70B |

| Deferred Revenue Non-Current | $1.21B | $1.20B | $1.20B | $1.23B | $1.28B | $1.29B | $1.32B | $1.36B | $2.05B | $2.19B | $2.21B | $2.27B | $2.80B | $2.91B | $3.02B | $3.06B | $3.25B | $3.21B | $3.36B | $3.35B |

| Deferred Tax Liabilities Non-Current | $66.00M | $- | $- | $- | $151.00M | $144.00M | $63.00M | $40.00M | $24.00M | $24.00M | $22.00M | $20.00M | $82.00M | $- | $- | $- | $- | $- | $- | $- |

| Other Non-Current Liabilities | $1.67B | $1.69B | $1.81B | $1.92B | $1.93B | $1.81B | $1.87B | $1.82B | $1.85B | $2.00B | $2.08B | $2.42B | $3.08B | $3.59B | $3.99B | $4.14B | $4.48B | $4.63B | $4.98B | $5.52B |

| Total Non-Current Liabilities | $15.53B | $14.59B | $14.53B | $14.89B | $14.22B | $13.63B | $12.53B | $11.29B | $10.84B | $9.18B | $9.03B | $8.69B | $9.73B | $10.16B | $10.82B | $12.81B | $14.26B | $14.59B | $17.84B | $18.57B |

| Other Liabilities | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- |

| Total Liabilities | $26.20B | $26.58B | $26.80B | $28.19B | $28.47B | $28.51B | $28.90B | $29.34B | $30.55B | $30.63B | $30.86B | $33.30B | $36.44B | $37.60B | $38.41B | $39.45B | $43.01B | $44.05B | $45.57B | $49.14B |

| Preferred Stock | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- |

| Common Stock | $1.00M | $- | $- | $1.00M | $1.00M | $1.00M | $1.00M | $1.00M | $3.00M | $1.00M | $1.00M | $3.00M | $3.00M | $3.00M | $3.00M | $3.00M | $3.00M | $3.00M | $3.00M | $3.00M |

| Retained Earnings | $-6.08B | $-6.10B | $-6.00B | $-5.67B | $-5.40B | $-4.75B | $-3.61B | $-1.99B | $329.00M | $3.65B | $5.91B | $9.20B | $12.88B | $15.40B | $18.10B | $19.95B | $27.88B | $29.01B | $30.49B | $32.66B |

| Accumulated Other Comprehensive Income Loss | $-36.00M | $-113.00M | $-40.00M | $125.00M | $363.00M | $143.00M | $206.00M | $120.00M | $54.00M | $-50.00M | $-477.00M | $-942.00M | $-361.00M | $-225.00M | $-410.00M | $-692.00M | $-143.00M | $-399.00M | $-467.00M | $-14.00M |

| Other Total Stockholders Equity | $12.74B | $15.39B | $15.89B | $21.57B | $27.26B | $27.62B | $28.20B | $28.92B | $29.80B | $30.48B | $30.94B | $31.59B | $32.18B | $32.88B | $33.44B | $34.20B | $34.89B | $35.76B | $36.44B | $37.29B |

| Total Stockholders Equity | $6.62B | $9.17B | $9.86B | $16.03B | $22.23B | $23.02B | $24.80B | $27.05B | $30.19B | $34.09B | $36.38B | $39.85B | $44.70B | $48.05B | $51.13B | $53.47B | $62.63B | $64.38B | $66.47B | $69.93B |

| Total Equity | $8.11B | $10.67B | $11.34B | $17.50B | $23.68B | $24.46B | $26.25B | $28.49B | $31.58B | $35.41B | $37.66B | $41.12B | $45.90B | $49.23B | $52.18B | $54.49B | $63.61B | $65.18B | $67.26B | $70.71B |

| Total Liabilities and Stockholders Equity | $34.31B | $37.25B | $38.13B | $45.69B | $52.15B | $52.97B | $55.15B | $57.83B | $62.13B | $66.04B | $68.51B | $74.43B | $82.34B | $86.83B | $90.59B | $93.94B | $106.62B | $109.23B | $112.83B | $119.85B |

| Minority Interest | $1.49B | $1.50B | $1.48B | $1.47B | $1.45B | $1.45B | $1.45B | $1.44B | $1.39B | $1.32B | $1.28B | $1.27B | $1.19B | $1.18B | $1.05B | $1.03B | $975.00M | $802.00M | $795.00M | $779.00M |

| Total Liabilities and Total Equity | $34.31B | $37.25B | $38.13B | $45.69B | $52.15B | $52.97B | $55.15B | $57.83B | $62.13B | $66.04B | $68.51B | $74.43B | $82.34B | $86.83B | $90.59B | $93.94B | $106.62B | $109.23B | $112.83B | $119.85B |

| Total Investments | $1.00M | $632.00M | $639.00M | $640.00M | $613.00M | $1.33B | $1.31B | $1.29B | $131.00M | $508.00M | $591.00M | $1.57B | $5.93B | $6.35B | $7.78B | $10.14B | $12.70B | $15.62B | $16.69B | $15.54B |

| Total Debt | $14.60B | $15.20B | $15.48B | $15.16B | $13.28B | $12.51B | $11.13B | $10.13B | $8.87B | $7.03B | $6.67B | $5.87B | $5.75B | $5.57B | $5.81B | $8.19B | $9.57B | $9.91B | $12.52B | $12.78B |

| Net Debt | $8.34B | $7.12B | $6.86B | $632.00M | $-6.11B | $-4.63B | $-5.10B | $-5.94B | $-8.70B | $-10.48B | $-11.66B | $-13.66B | $-10.51B | $-10.47B | $-9.48B | $-7.75B | $-6.83B | $-1.89B | $-2.12B | $-5.33B |

Annual Cash Flow Statement

| Breakdown | 2019-12-31 | 2020-12-31 | 2021-12-31 | 2022-12-31 | 2023-12-31 |

|---|---|---|---|---|---|

| Net Income | $- | $690.00M | $5.52B | $12.56B | $14.97B |

| Depreciation and Amortization | $2.09B | $2.32B | $2.91B | $3.54B | $4.67B |

| Deferred Income Tax | $- | $- | $-149.00M | $-196.00M | $-6.35B |

| Stock Based Compensation | $898.00M | $1.73B | $2.12B | $1.56B | $1.81B |

| Change in Working Capital | $- | $- | $- | $-3.91B | $-2.25B |

| Accounts Receivables | $- | $-652.00M | $-130.00M | $-1.12B | $-586.00M |

| Inventory | $-429.00M | $-422.00M | $-1.71B | $-6.46B | $-1.20B |

| Accounts Payables | $646.00M | $930.00M | $4.58B | $6.03B | $2.60B |

| Other Working Capital | $- | $328.00M | $-2.22B | $-2.35B | $-3.07B |

| Other Non Cash Items | $-585.00M | $1.20B | $1.09B | $1.17B | $400.00M |

| Net Cash Provided by Operating Activities | $2.40B | $5.94B | $11.50B | $14.72B | $13.26B |

| Investments in Property Plant and Equipment | $-1.44B | $-3.24B | $-6.51B | $-7.16B | $-8.90B |

| Acquisitions Net | $-45.00M | $-13.00M | $- | $- | $-64.00M |

| Purchases of Investments | $- | $- | $-132.00M | $-5.83B | $-19.11B |

| Sales Maturities of Investments | $- | $- | $- | $22.00M | $12.49B |

| Other Investing Activities | $46.00M | $123.00M | $-1.22B | $1.00B | $- |

| Net Cash Used for Investing Activities | $-1.44B | $-3.13B | $-7.87B | $-11.97B | $-15.58B |

| Debt Repayment | $798.00M | $-2.49B | $-5.73B | $-3.87B | $2.09B |

| Common Stock Issued | $848.00M | $12.27B | $- | $- | $- |

| Common Stock Repurchased | $- | $- | $- | $- | $- |

| Dividends Paid | $- | $- | $- | $- | $- |

| Other Financing Activities | $-117.00M | $192.00M | $-178.00M | $-202.00M | $502.00M |

| Net Cash Used Provided by Financing Activities | $1.53B | $9.97B | $-5.20B | $-3.53B | $2.59B |

| Effect of Forex Changes on Cash | $8.00M | $334.00M | $-183.00M | $-444.00M | $4.00M |

| Net Change in Cash | $2.51B | $13.12B | $-1.76B | $-1.22B | $265.00M |

| Cash at End of Period | $6.78B | $19.90B | $18.14B | $16.92B | $17.19B |

| Cash at Beginning of Period | $4.28B | $6.78B | $19.90B | $18.14B | $16.92B |

| Operating Cash Flow | $2.40B | $5.94B | $11.50B | $14.72B | $13.26B |

| Capital Expenditure | $-1.43B | $-3.24B | $-8.01B | $-7.17B | $-8.90B |

| Free Cash Flow | $968.00M | $2.70B | $3.48B | $7.55B | $4.36B |

Quarterly Cash Flow Statement

| Breakdown | 2019-12-31 | 2020-03-31 | 2020-06-30 | 2020-09-30 | 2020-12-31 | 2021-03-31 | 2021-06-30 | 2021-09-30 | 2021-12-31 | 2022-03-31 | 2022-06-30 | 2022-09-30 | 2022-12-31 | 2023-03-31 | 2023-06-30 | 2023-09-30 | 2023-12-31 | 2024-03-31 | 2024-06-30 | 2024-09-30 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net Income | $105.00M | $16.00M | $104.00M | $300.00M | $270.00M | $438.00M | $1.14B | $1.62B | $2.32B | $3.28B | $2.26B | $3.29B | $3.69B | $2.51B | $2.70B | $1.85B | $7.91B | $1.13B | $1.48B | $2.17B |

| Depreciation and Amortization | $577.00M | $553.00M | $567.00M | $584.00M | $618.00M | $621.00M | $681.00M | $761.00M | $848.00M | $880.00M | $922.00M | $956.00M | $989.00M | $1.05B | $1.15B | $1.24B | $1.23B | $1.25B | $1.28B | $1.35B |

| Deferred Income Tax | $- | $- | $- | $- | $- | $-54.00M | $- | $- | $- | $- | $- | $- | $- | $-55.00M | $603.00M | $- | $-279.00M | $-11.00M | $- | $285.00M |

| Stock Based Compensation | $281.00M | $211.00M | $347.00M | $543.00M | $633.00M | $614.00M | $474.00M | $475.00M | $558.00M | $418.00M | $361.00M | $362.00M | $419.00M | $418.00M | $445.00M | $465.00M | $484.00M | $524.00M | $439.00M | $457.00M |

| Change in Working Capital | $231.00M | $-1.45B | $-246.00M | $635.00M | $1.06B | $-12.00M | $-324.00M | $-1.00M | $337.00M | $-602.00M | $-1.35B | $231.00M | $-2.19B | $-1.53B | $-1.05B | $-415.00M | $-205.00M | $-2.66B | $138.00M | $1.57B |

| Accounts Receivables | $-217.00M | $-14.00M | $-222.00M | $-314.00M | $-102.00M | $-24.00M | $-259.00M | $135.00M | $18.00M | $-409.00M | $176.00M | $-193.00M | $-698.00M | $-32.00M | $-472.00M | $881.00M | $-963.00M | $-422.00M | $137.00M | $429.00M |

| Inventory | $56.00M | $-1.18B | $313.00M | $-67.00M | $180.00M | $-106.00M | $-155.00M | $-488.00M | $-534.00M | $-633.00M | $-1.56B | $-2.30B | $-1.97B | $-1.54B | $-576.00M | $163.00M | $758.00M | $-2.70B | $1.78B | $-193.00M |

| Accounts Payables | $540.00M | $-265.00M | $-107.00M | $898.00M | $1.34B | $672.00M | $345.00M | $1.17B | $1.81B | $997.00M | $409.00M | $3.25B | $1.37B | $797.00M | $137.00M | $-2.00M | $- | $1.25B | $-998.00M | $2.25B |

| Other Working Capital | $149.00M | $-240.00M | $-290.00M | $189.00M | $259.00M | $-128.00M | $171.00M | $201.00M | $-443.00M | $- | $37.00M | $2.72B | $-890.00M | $-755.00M | $-190.00M | $-614.00M | $226.00M | $- | $-1.78B | $-917.00M |

| Other Non Cash Items | $231.00M | $227.00M | $192.00M | $338.00M | $440.00M | $34.00M | $151.00M | $294.00M | $521.00M | $19.00M | $158.00M | $259.00M | $374.00M | $121.00M | $-792.00M | $172.00M | $-4.77B | $15.00M | $279.00M | $419.00M |

| Net Cash Provided by Operating Activities | $1.43B | $-440.00M | $964.00M | $2.40B | $3.02B | $1.64B | $2.12B | $3.15B | $4.58B | $4.00B | $2.35B | $5.10B | $3.28B | $2.51B | $3.06B | $3.31B | $4.37B | $242.00M | $3.61B | $6.25B |

| Investments in Property Plant and Equipment | $-449.00M | $-481.00M | $-566.00M | $-1.03B | $-1.16B | $-1.36B | $-1.51B | $-1.82B | $-1.81B | $-1.77B | $-1.73B | $-1.80B | $-1.86B | $-2.07B | $-2.06B | $-2.46B | $-2.31B | $-2.78B | $-2.27B | $-3.51B |

| Acquisitions Net | $- | $- | $- | $-13.00M | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $-79.00M | $12.00M | $-37.00M | $-101.00M | $-23.00M | $- |

| Purchases of Investments | $- | $- | $- | $- | $- | $- | $- | $-30.00M | $-102.00M | $-386.00M | $-90.00M | $-991.00M | $-4.37B | $-2.02B | $-5.08B | $-6.13B | $-5.89B | $-6.62B | $-8.14B | $-6.03B |

| Sales Maturities of Investments | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $3.00M | $19.00M | $1.60B | $- | $3.82B | $3.39B | $4.32B | $7.19B | $6.67B |

| Other Investing Activities | $46.00M | $1.00M | $- | $- | $118.00M | $-1.22B | $- | $- | $- | $-9.00M | $936.00M | $- | $50.00M | $- | $3.68B | $- | $37.00M | $101.00M | $23.00M | $- |

| Net Cash Used for Investing Activities | $-403.00M | $-480.00M | $-566.00M | $-1.04B | $-1.05B | $-2.58B | $-1.51B | $-1.85B | $-1.92B | $-2.17B | $-884.00M | $-2.79B | $-6.16B | $-2.48B | $-3.53B | $-4.76B | $-4.80B | $-5.08B | $-3.23B | $-2.88B |

| Debt Repayment | $-195.00M | $287.00M | $111.00M | $-581.00M | $-2.31B | $-1.16B | $-1.59B | $-1.53B | $-1.46B | $-2.07B | $-402.00M | $-899.00M | $-497.00M | $-408.00M | $-357.00M | $2.06B | $817.00M | $79.00M | $2.39B | $-181.00M |

| Common Stock Issued | $- | $2.31B | $57.00M | $4.97B | $4.99B | $- | $70.00M | $192.00M | $262.00M | $- | $43.00M | $229.00M | $67.00M | $- | $- | $2.78B | $-2.37B | $- | $197.00M | $-448.00M |

| Common Stock Repurchased | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- |

| Dividends Paid | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- | $- |

| Other Financing Activities | $116.00M | $112.00M | $12.00M | $58.00M | $10.00M | $-37.00M | $-31.00M | $-47.00M | $199.00M | $-48.00M | $-4.00M | $187.00M | $2.00M | $-56.00M | $29.00M | $199.00M | $70.00M | $117.00M | $152.00M | $313.00M |

| Net Cash Used Provided by Financing Activities | $-79.00M | $2.71B | $123.00M | $4.45B | $2.69B | $-1.02B | $-1.55B | $-1.38B | $-1.26B | $-1.91B | $-406.00M | $-712.00M | $-495.00M | $-233.00M | $-328.00M | $2.26B | $887.00M | $196.00M | $2.54B | $132.00M |

| Effect of Forex Changes on Cash | $14.00M | $-24.00M | $38.00M | $86.00M | $234.00M | $-221.00M | $42.00M | $-42.00M | $38.00M | $-18.00M | $-214.00M | $-335.00M | $123.00M | $50.00M | $-94.00M | $-98.00M | $146.00M | $-79.00M | $-37.00M | $108.00M |

| Net Change in Cash | $957.00M | $1.76B | $559.00M | $5.90B | $4.90B | $-2.18B | $-898.00M | $-131.00M | $1.45B | $-104.00M | $847.00M | $1.26B | $-3.23B | $-154.00M | $- | $711.00M | $599.00M | $-4.72B | $2.89B | $3.96B |

| Cash at End of Period | $6.78B | $8.55B | $9.11B | $15.00B | $19.90B | $17.72B | $16.82B | $16.69B | $18.14B | $18.04B | $18.89B | $20.15B | $16.92B | $16.77B | $15.88B | $16.59B | $17.19B | $12.46B | $15.35B | $18.97B |

| Cash at Beginning of Period | $5.83B | $6.78B | $8.55B | $9.11B | $15.00B | $19.90B | $17.72B | $16.82B | $16.69B | $18.14B | $18.04B | $18.89B | $20.15B | $16.92B | $16.53B | $15.88B | $16.59B | $17.19B | $12.46B | $15.01B |

| Operating Cash Flow | $1.43B | $-440.00M | $964.00M | $2.40B | $3.02B | $1.64B | $2.12B | $3.15B | $4.58B | $4.00B | $2.35B | $5.10B | $3.28B | $2.51B | $3.06B | $3.31B | $4.37B | $242.00M | $3.61B | $6.25B |

| Capital Expenditure | $-449.00M | $-481.00M | $-566.00M | $-1.03B | $-1.17B | $-2.86B | $-1.51B | $-1.82B | $-1.81B | $-1.78B | $-1.73B | $-1.80B | $-1.86B | $-2.07B | $-2.06B | $-2.46B | $-2.31B | $-2.78B | $-2.27B | $-3.51B |

| Free Cash Flow | $976.00M | $-921.00M | $398.00M | $1.37B | $1.85B | $-1.22B | $609.00M | $1.32B | $2.77B | $2.21B | $621.00M | $3.30B | $1.42B | $440.00M | $1.00B | $849.00M | $2.06B | $-2.54B | $1.34B | $2.74B |

Tesla Dividends

Understand Tesla's dividend history, dividend yield, payout ratio, and more.

Dividend Yield

-

Dividend Payout Ratio

-

Dividend Paid & Capex Coverage Ratio

1.49x

Tesla Dividend History

| Dividend | Adjusted Dividend | Date | Record Date | Payment Date | Declaration Date |

|---|

Valuation

Analyze the market cap, enterprise value, and valuation metrics for Tesla.

Market Cap & Enterprise Value

Market Cap: $1.13T

Enterprise Value: $781.85B

Valuation Ratios

P/E Ratio: 52.58

P/B Ratio: 12.59

P/CF Ratio: 59.50

Valuation Multiples

E/V to Sales: 8.08

E/V to EBITDA: 52.84

Market Cap & Enterprise Value

Market capitalization and enterprise value provide an understanding of a company's market value and total value, respectively.

- Market Cap: The total market value of a company's outstanding shares of stock. It represents the company's equity value and is calculated by multiplying the current share price by the total number of outstanding shares.

- Enterprise Value (EV): A measure of a company's total value, often seen as a more comprehensive alternative to equity market capitalization. It includes market cap plus debt, minority interest, and preferred shares, minus total cash and cash equivalents.

Valuation Ratios

Valuation ratios are used to evaluate the value of a company compared to its earnings, book value, and cash flow.

- P/E Ratio: Price to Earnings Ratio, indicating how much investors are willing to pay for a dollar of earnings.

- P/B Ratio: Price to Book Ratio, comparing the company's market value to its book value. A lower ratio may indicate undervaluation.

- P/CF Ratio: Price to Cash Flow Ratio, evaluating the market value relative to the operating cash flow. A lower ratio can signal a more attractive investment.

Valuation Multiples

Valuation multiples help assess a company's value relative to its revenue and earnings.

- EV to Sales: Enterprise Value to Sales, comparing the enterprise value to sales revenue. A lower ratio can indicate a more attractive investment.

- EV to EBITDA: Enterprise Value to EBITDA, comparing the enterprise value to earnings before interest, taxes, depreciation, and amortization. A lower ratio suggests a company may be undervalued.

Tesla Growth

View income_statement_chart2_annual_data financial growth metrics for Tesla, including income statement, balance sheet, and cash flow growth.

Income Growth

Revenue Growth: -1.25%

Operating Income Growth: 69.28%

Cash Flow Growth

Net Income Growth: 46.96%

Free Cash Flow Growth: 104.63%

Balance Sheet Growth

Total Assets Growth: 6.22%

Total Liabilities Growth: 7.84%

Income Growth

This section highlights key metrics related to income growth, showing how the company’s revenue and operating income have changed over time:

- Revenue Growth: The increase in a company's sales over time. It is a measure of how quickly the company is growing its revenue. This chart shows the historical trend of revenue growth.

- Operating Income Growth: The growth rate of a company's operating income, which is the income earned from its normal business operations. This chart helps to assess the company's operational efficiency and profitability growth over time.

Cash Flow Growth

This section highlights key metrics on the company's cash flow growth, reflecting changes in net income and free cash flow over time.

- Net Income Growth: The increase in a company's net profit over time. It reflects the company's ability to increase its profitability. This chart provides insight into how the company's bottom line has grown.

- Free Cash Flow Growth: The growth in a company's free cash flow, which is the cash generated by the company after accounting for capital expenditures. This chart is important for understanding the company's financial flexibility and ability to fund operations and growth.

Balance Sheet Growth

This section highlight key metrics related to balance sheet growth, which indicate how the company’s total assets and liabilities have changed over time:

- Total Assets Growth: The rate at which a company's total assets are increasing over time. This chart indicates how the company's asset base is expanding, which can be a sign of growth and investment in future operations.

- Total Liabilities Growth: The rate at which a company's total liabilities are increasing over time. This chart helps to assess the company's financial leverage and risk over time.

Peers: Auto - Manufacturers

This section provides companies within the same sector, on the same exchange, and of similar market capitalization, allowing comparisons of key financial indicators among peers.

| Company | Market Cap | Price | EPS | P/E Ratio | P/B Ratio |

|---|---|---|---|---|---|

XPeng Inc.

XPEV

|

$11.85B | $11.91 | $-11.92 | $-4.31 | $1.23 |

Li Auto Inc.

LI

|

$22.67B | $22.28 | $11.10 | $11.38 | $2.22 |

Rivian Automotive, Inc.

RIVN

|

$10.24B | $10.24 | $-5.74 | $-4.09 | $2.43 |

Lucid Group, Inc.

LCID

|

$6.32B | $2.10 | $-1.36 | $-3.10 | $1.81 |

General Motors Company

GM

|

$64.36B | $58.53 | $7.42 | $4.84 | $0.76 |

NIO Inc.

NIO

|

$8.96B | $4.84 | $-12.44 | $-5.18 | $4.28 |

Ford Motor Company

F

|

$43.64B | $11.18 | $1.09 | $11.21 | $1.14 |

Fisker Inc.

FSR

|

$52.82M | $0.09 | $-2.73 | $-0.60 | $-5.72 |

Mullen Automotive, Inc.

MULN

|

$25.86M | $2.93 | $-1586.15 | $-2.86 | $13.32 |

More metrics for Tesla

Access more key metrics, financials, ratios, and more with the links below.