What is DeFi?

DeFi, or Decentralized Finance, is a revolutionary way that investors are using secure digital ledgers to conduct peer-to-peer financial transactions. It is often grouped in with cryptocurrencies, and the two do operate on similar technology, but whereas cryptocurrencies are the token, DeFi is the platform or application they are used on.

To use DeFi you do still have to convert your fiat currency into cryptocurrencies. While you can use benchmark cryptos like bitcoin or Ethereym, there are plenty of specific DeFi tokens that you can swap to. DeFi also uses stablecoins as well, which is a cryptocurrency that is pegged to a fiat currency, usually the US Dollar.

DeFi can be as simple as staking your cryptocurrencies in a DeFi account where you will receive an APY, or Annual Percentage Yield or an APR or Annual Percentage Return. Think of these as DeFi interest rates that provide you with an incentive to stake your coins.

The possibilities with DeFi are seemingly endless with options like liquid swaps, liquidity pools, and yield farming, to name a few.

Is DeFi the future of finance?

It certainly seems like it is headed that way. Much of the DeFi networks right now run on the Ethereum blockchain, with over $90 billion already staked & invested in these protocols. As we continue to move into a more digital world, DeFi is likely to be adopted as a mainstream and legitimate way to have control over your finances without paying fees to a financial middleman.

So without further ado, here are 20 DeFi tokens and projects that are worth looking into for 2022.

Stay up to date with AI

Top DeFi Tokens to Watch

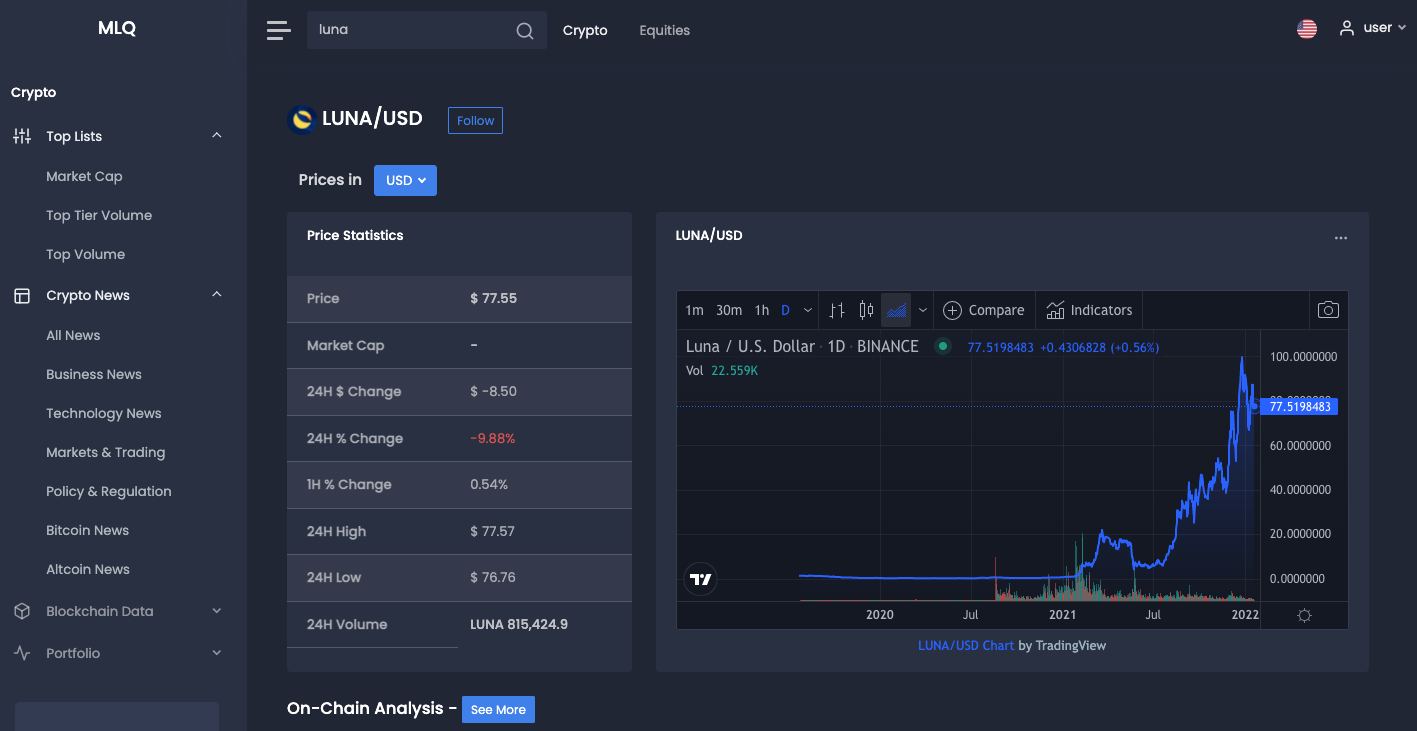

Terra (LUNA)

Currently ranked as the top DeFi token by market cap, Terra and its native token, Luna, have been on a historic run since the start of 2021. Luna entered the year priced at below 1.00 USD, and hit an all-time high price of $103.33 USD in late-December.

Terra is a DeFi project that was founded by two South Korean entrepreneurs named Daniel Shin and Do Kwon in 2018. The intention of Terra is to create a DeFi protocol that creates algorithmic stablecoins through a proof of stake model.

Without going into all of the technical details, Terra is building a transaction and payment platform that offers retailers a significantly lower transaction fee than existing infrastructure. The Proof of Stake network also uses significantly less energy than other platforms. Terra has gained immense popularity by both investors and businesses alike, and is seen by many to be an important protocol in the long-run.

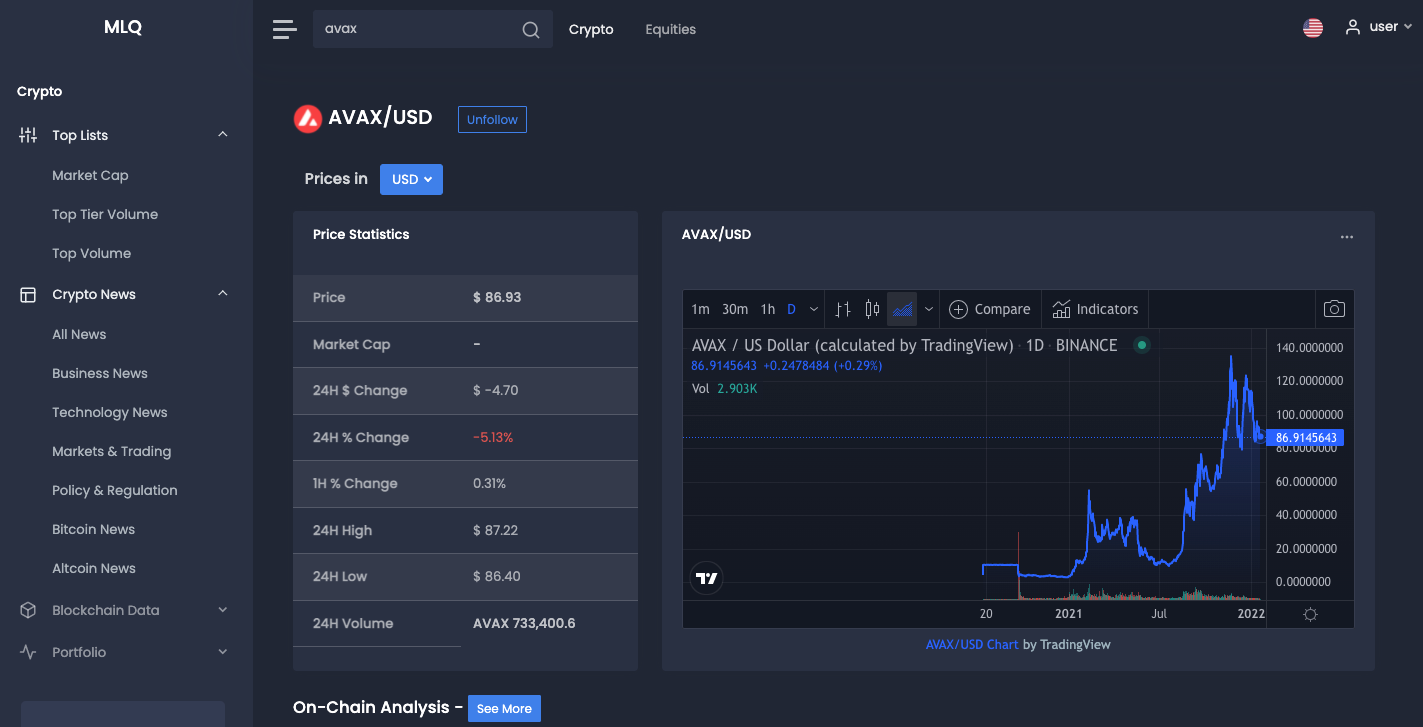

Avalanche (AVAX)

The Avalanche protocol seemingly came out of nowhere last year to be the second largest DeFi token in market cap behind Terra. Like many cryptos, AVAX soared in 2021 from an initial price below 10 per token, to an all-time high price of $146 per token.

To put things simply, the Avalanche network can be used to create their own customer blockchain. It is its own network of blockchains that can be customized to suit the needs of any specific user. In terms of why AVAX gained so much popularity this past year, its TPS or transactions per second sits at an impressive 4,500. This is compared to the current iteration of Ethereum which can only handle 15-30 transactions per second.

Avalanche’s version of gas fees are also an appealing case for investors and blockchain users as its fees are much lower than those of Ethereum. This has convinced some real-world use cases for Avalanche including a long list of NFT projects as well as an AVAX-based game called Crabada.

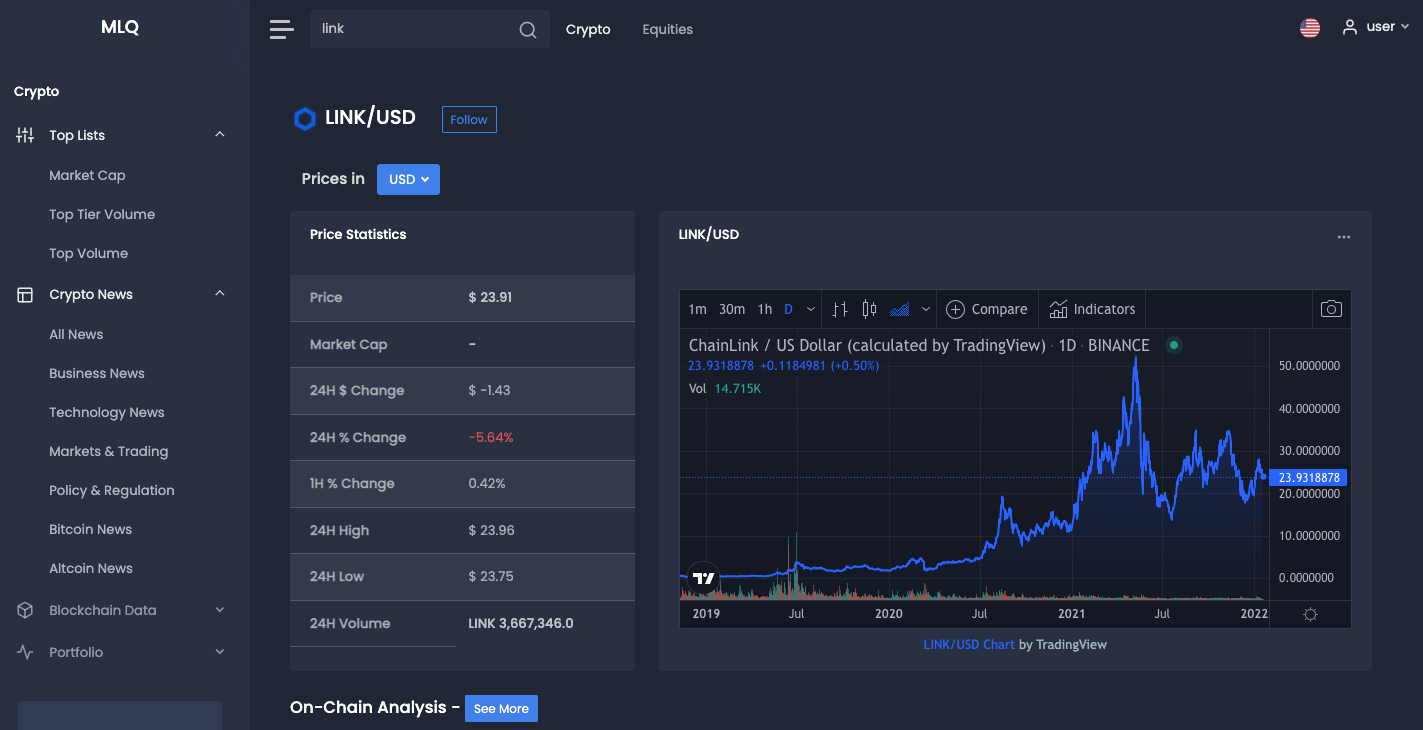

Chainlink (LINK)

Chainlink is likely one of the more recognizable names on this list as it has been around the DeFi space since 2017. It is built on the Ethereum network, and was founded by Sergey Nazarov and Steve Ellis and provides the ability for blockchains to communicate with off-chain environments.

What exactly does this mean? It means that it can be used to integrate non-blockchain data into a specific blockchain. This is much more applicable to real-world uses like a non-blockchain company moving its data onto the blockchain. The end-blockchain isn’t Chainlink, but the utility that links the two worlds is Chainlink. Analysts are quite bullish on LINK which has traded as high as $52.88 per token, although it is currently in the high 20’s.

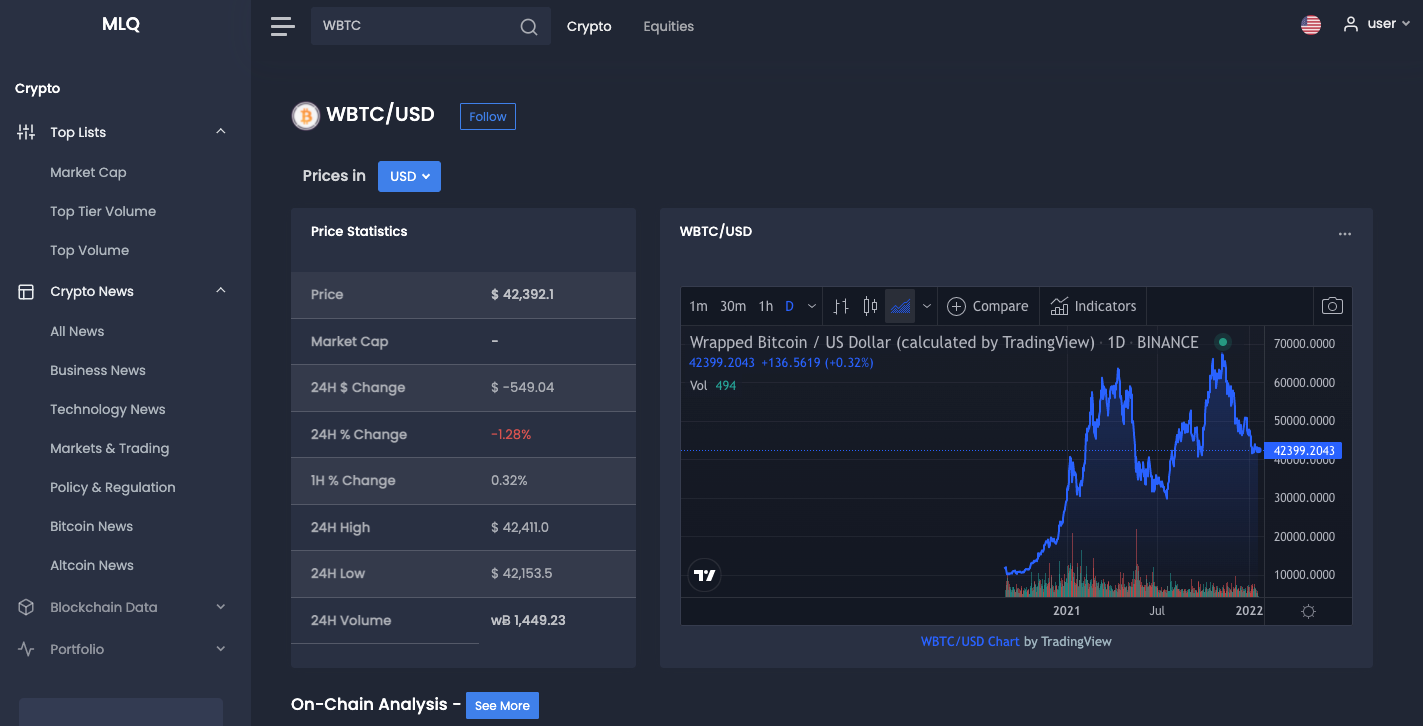

Wrapped Bitcoin (WBTC)

You know what Bitcoin is, but do you know what it means for it to be wrapped? When a cryptocurrency is wrapped it means that it is pegged against the original token, but made available for use on a different host blockchain. In this case, think of this as Bitcoin tokens you can use on the Ethereum network.

Wrapped Bitcoin was founded back in 2017 in Singapore by Loi Luu, Victor Tran, and Yaron Velner, alongside Ren and the Kyber Network. The supply of Wrapped Bitcoin is regularly burned to keep pace with regular Bitcoin so that it maintains its value. Wrapped Bitcoin is primarily used for financial transactions and integration with Dapps on the Ethereum Network.

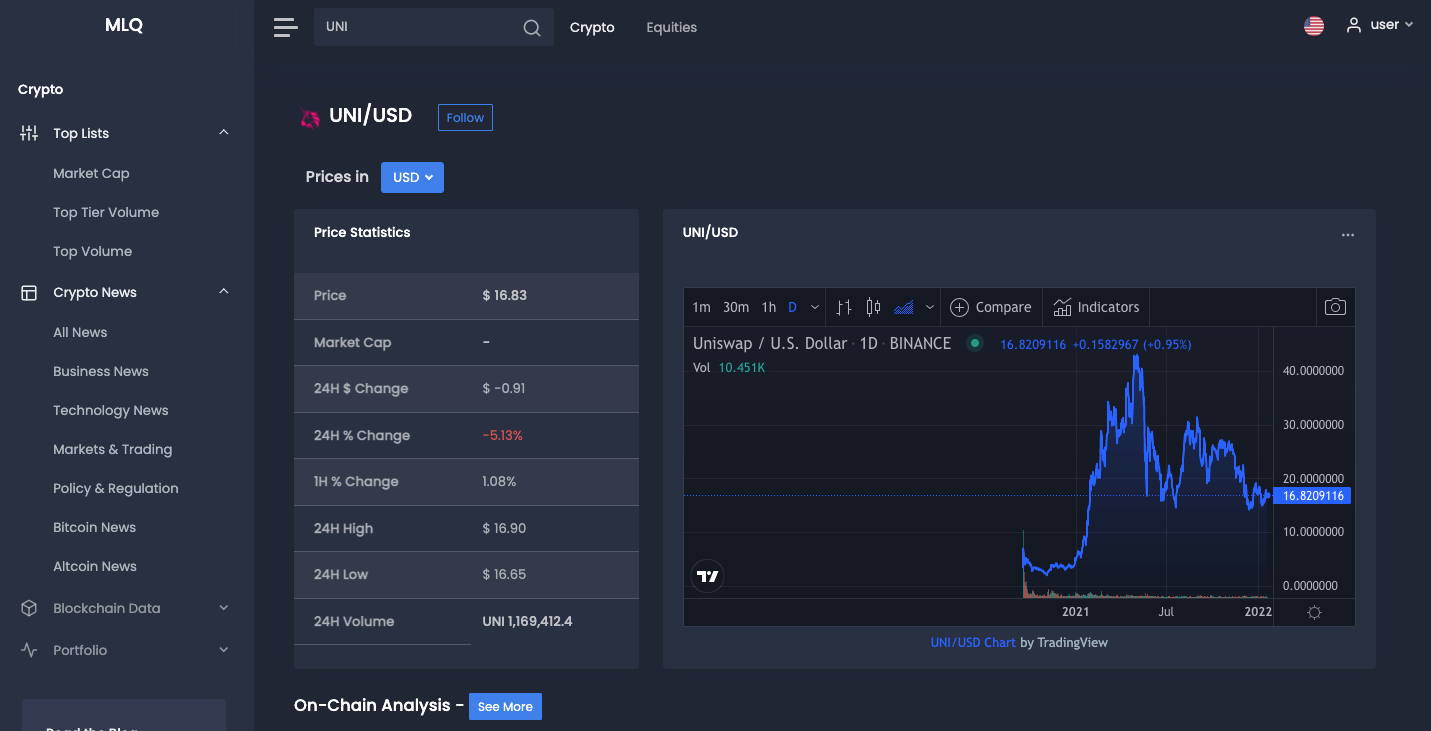

Uniswap (UNI)

Uniswap is a DeFi protocol that can be used by any users to exchange cryptos, particularly ones that aren’t found on regular crypto exchanges. It is based on the Ethereum network and is the largest decentralized exchange network in the world by daily transaction volume.

Uniswap was founded back in 2018 by an ex-Siemens mechanical engineer named Hayden Adams. Rather than operating like a centralized exchange like Binance or Coinbase, Uniswap is unique in that it uses liquidity pools. There aren’t any fees to list new tokens on Uniswap and no registration for its users, so there have been a large amount of Ethereum-based tokens created by users.

Uniswap currently has a market cap of over 10 billion USD, and is trading significantly lower than its all-time high from 2021 of $44.97 per UNI token.

Dai (DAI)

The first thing you will notice about Dai is that its native token, also called Dai, is almost always hovering around the $1.00 level. That is because Dai is a stablecoin that is pegged to the US Dollar, similar to Tether and USDC.

It is one of the first DeFi projects that is regulated and maintained by a DAO, or a Decentralized Autonomous Organization. The basis of Dai is for funding over collateralized loans. Basically, an investor can put up a cryptocurrency as collateral, and receive back a loan that is funded in Dai. This is similar to how other stablecoins operated as well, which makes Dai a valuable utility in the world of DeFi loans.

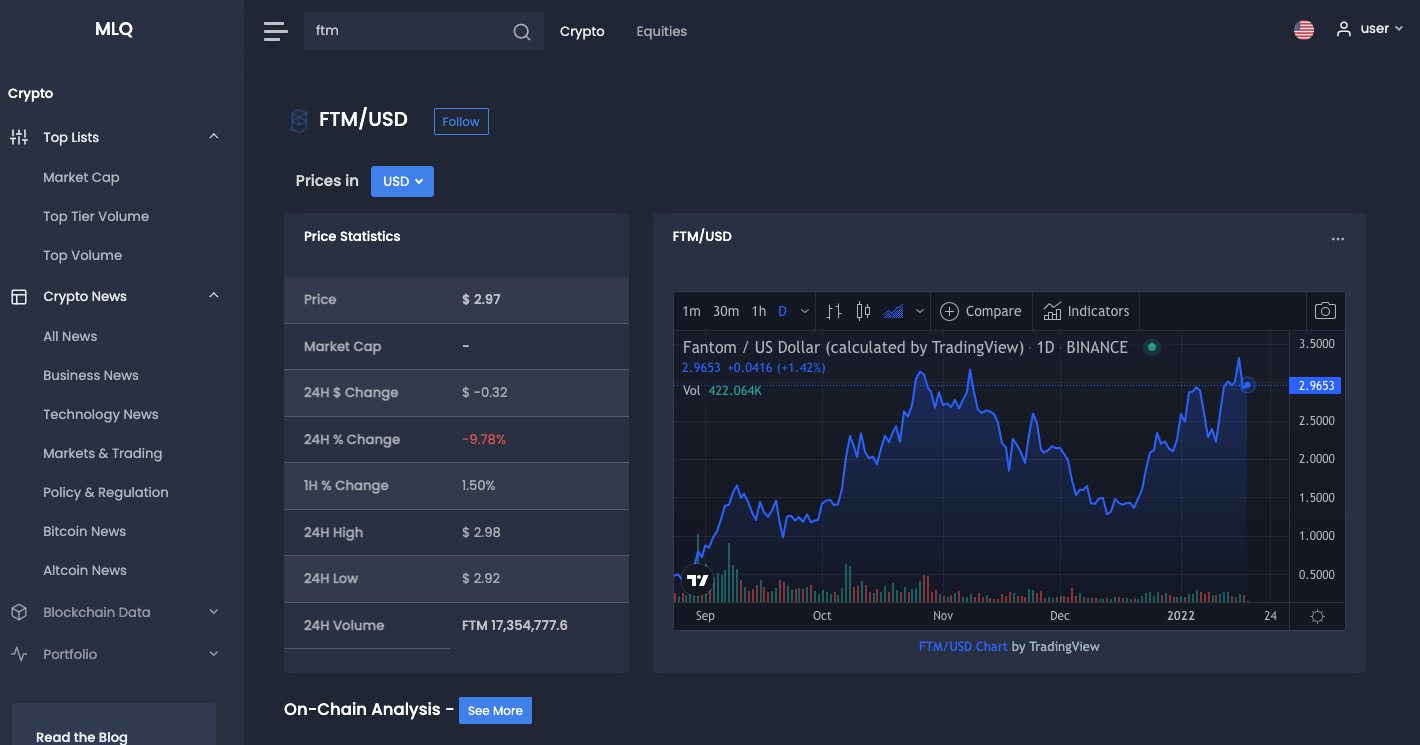

Fantom (FTM)

If you follow the crypto markets, Fantom has undoubtedly come to your attention over the past few months. Fantom has been one of the more popular DeFi blockchains that is rapidly gaining popularity amongst investors.

At the start of 2021, FTM was trading for less than a penny, and just one year later it is trading for more than $3.20 per token. Many crypto enthusiasts think the price of FTM can soar even more this year, but what has everyone so excited?

The Fantom blockchain is one that provides smart contracts for integration with Dapps and other digital assets. The name of the game with Fantom is speed and scalability.

Right now, Fantom is one of the fastest blockchains around, and can handle thousands of transactions per second, similar to Avalanche and Solana. On top of that, Fantom’s team which includes South Korean computer scientist Dr. Ahn Byung Ik and CEO Michael Kong, have made the Fantom blockchain compatible with Solidity which is the native language of Ethereum’s smart contracts. This means that theoretically if Fantom gains more adoption, Ethereum based applications can easily transfer Dapps over to Fantom. Keep an eye on this one in 2022!

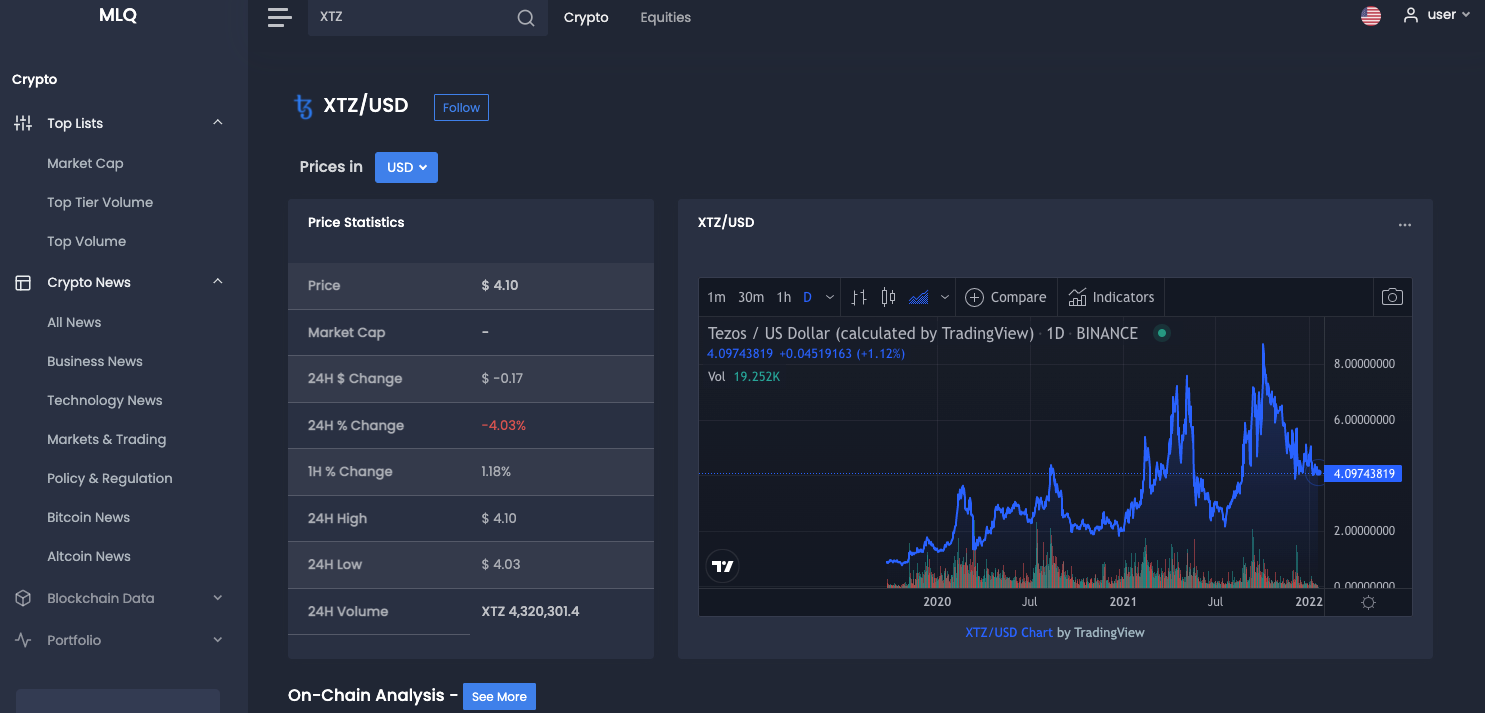

Tezos (XTZ)

Tezos got off to a hot start when it was first introduced back in 2018, but the blockchain has been somewhat of a disappointment since then. Tezos is built upon an open source blockchain that is intended to make ease of peer-to-peer financial transactions through smart contracts.

It was found by Arthur and Kathleen Breitman who were helped by Johann Gevers, who founded the Tezos Foundation in Switzerland to avoid US tax laws. The project has been marred by controversy over the past few years, including a public dispute between Gevers and the Breitmans about who owns the Tezos brand. After numerous lawsuits and controversies, it seems as though investors have looked to other DeFi tokens until the smoke has cleared.

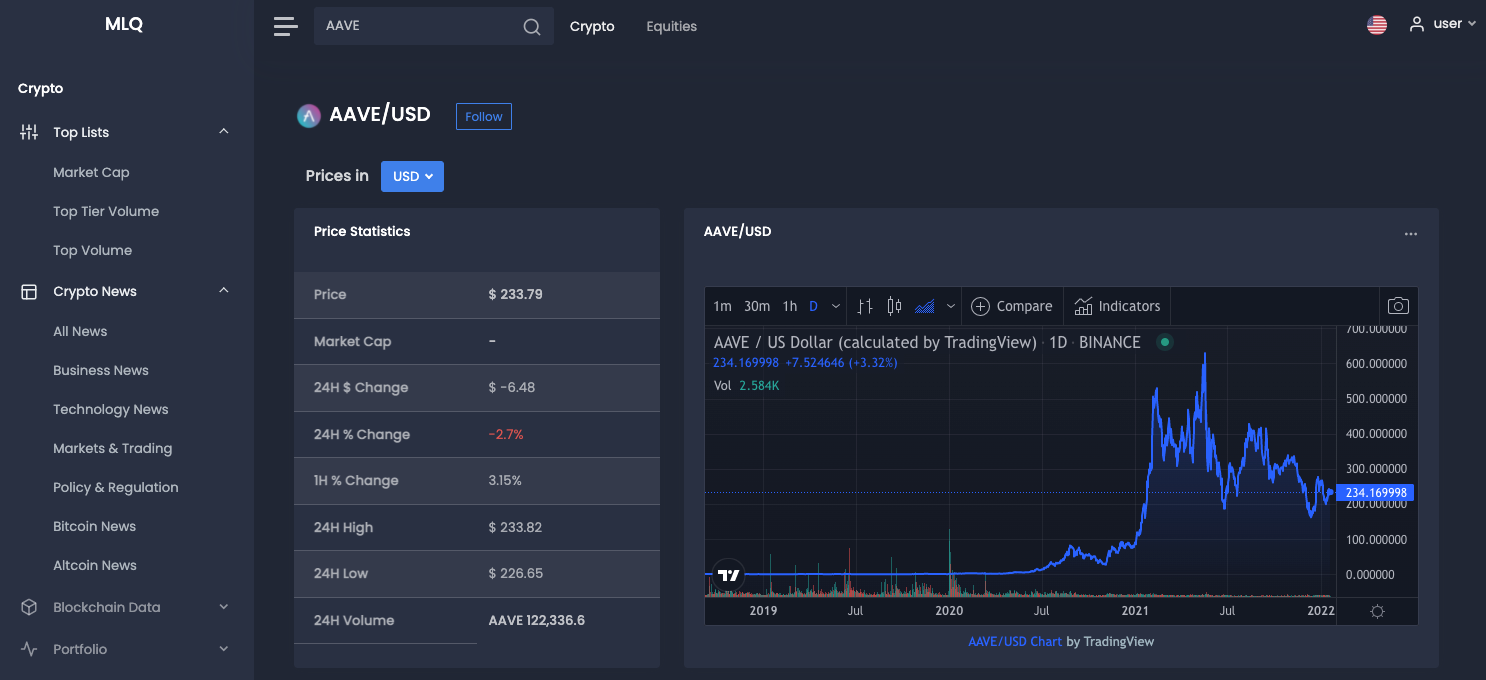

AAVE (AAVE)

AAVE is a decentralized protocol for lending and borrowing cryptocurrencies. The platform uses liquidity pools to generate capital for lending, and has even introduced a new type of crypto loan called the flash loan which does not require crypto collateral in return.

AAVE is once again based on the Ethereum network and was founded by the very personable and eccentric Stani Kulechov back in 2017. Kulechov has hinted at several new projects for AAVE including a social media platform and a debit card that integrates with your crypto loans.

There are 16 million AAVE tokens in circulation and as of now, it doesn’t look like there will be anymore created. AAVE has a TVL or Total Value Locked of nearly $20 billion.

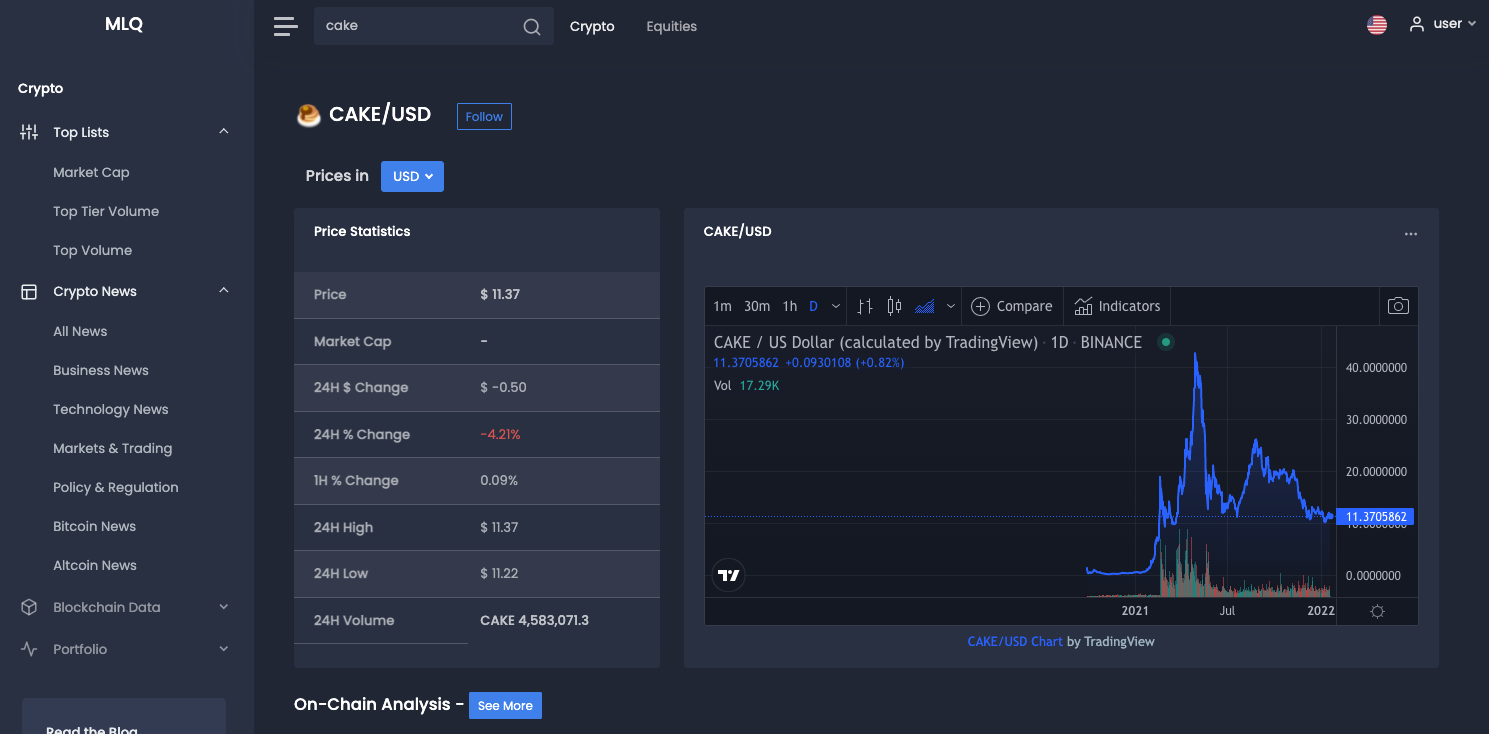

Pancake Swap (CAKE)

We already talked about Uniswap, which is a crypto exchange used with the Ethereum network. Well, Pancake Swap is a similar idea except it operates on the Binance Smart Chain network.

Pancake Swap is considered a DEX or decentralized exchange, where users can swap BEP-20 tokens for other tokens that are based on the Binance Smart Chain. By replacing Ethereum with Binance, lower fees are the first thing that comes to mind.

You can also stake CAKE unlike UNI, so if you buy CAKE tokens you can farm them for a nice yield return. Finally, Pancake Swap is integrated with all of the more popular wallets including MetaMask and Trust Wallet. WIth high APY for staking and lower BSC fees, it is easy to see why Pancake Swap is gaining on its rival Uniswap.

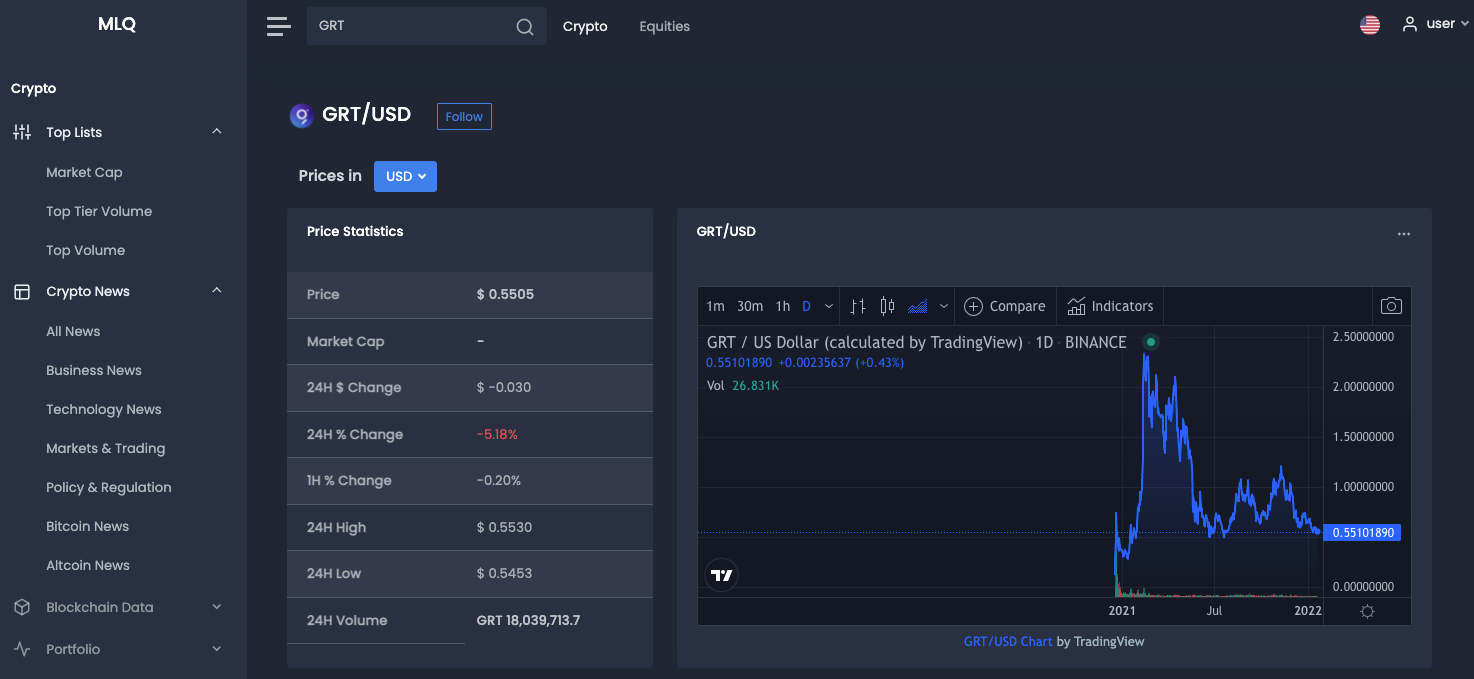

The Graph (GRT)

The Graph might have a peculiar name but it has a very important job on the Ethereum blockchain. It is an open-source software that was first created by the trio of Yaniv Tal, Jannis Pohlmann, and Brandon Ramirez, in 2018. The Graph is a sprawling network that helps Ethereum developers improve the efficiency of their decentralized apps by facilitating information retrieval and providing these developers with relevant data.

It is a critical utility token that is being adopted by projects across several blockchains including Curve, AAVE, and Uniswap. The world of the Graph has three distinct user groups: curators, delegators, and indexers. Each user base has a specific role and can earn a portion of the Graph’s network fees as they help to run it as an efficient blockchain.

As for the token GRT, it has had a pullback as of late, off of its previous highs of $2.88 and is currently trading at just above 0.50 per GRT.

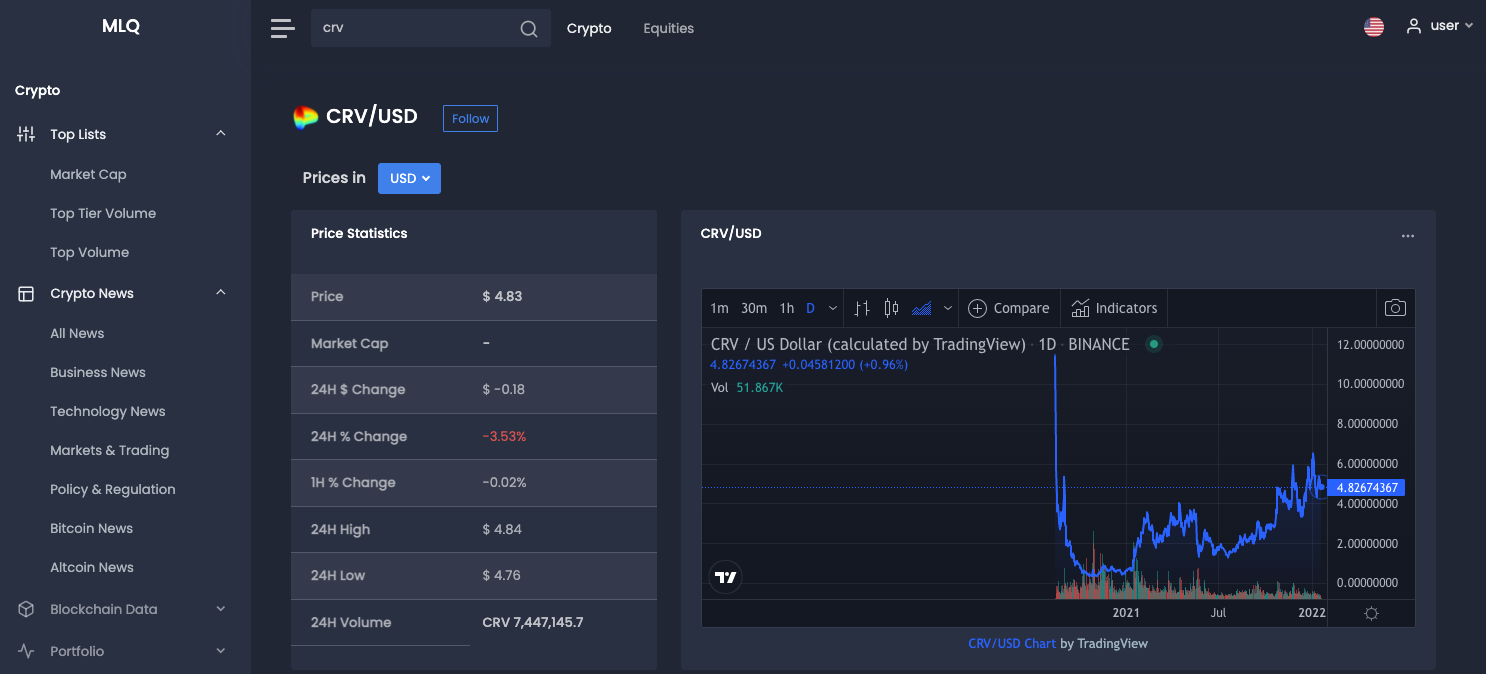

Curve DAO Token (CRV)

Here’s a name that has been making some headlines in the crypto world over the past few months. The Curve DAO Token is another decentralized exchange built upon the Ethereum network.

Its token of governance is CRV and was founded by Russian computer scientist Michael Egorov. While it does compete with other DEXs like Uniswap and Sushswap, what makes Curve DAO unique is that it is an exchange that primarily focuses on stablecoins. It also uses an Automated Market Maker or AMM to manage the exchange’s liquidity. Curve is actually the largest DEX on the Ethereum network by TVL or Total Locked Value with over $15 billion compared to Uniswap’s 7 billion.

CRV token is trading below its 52-week high of $6.74 and has generally traded in range for most of its existence.

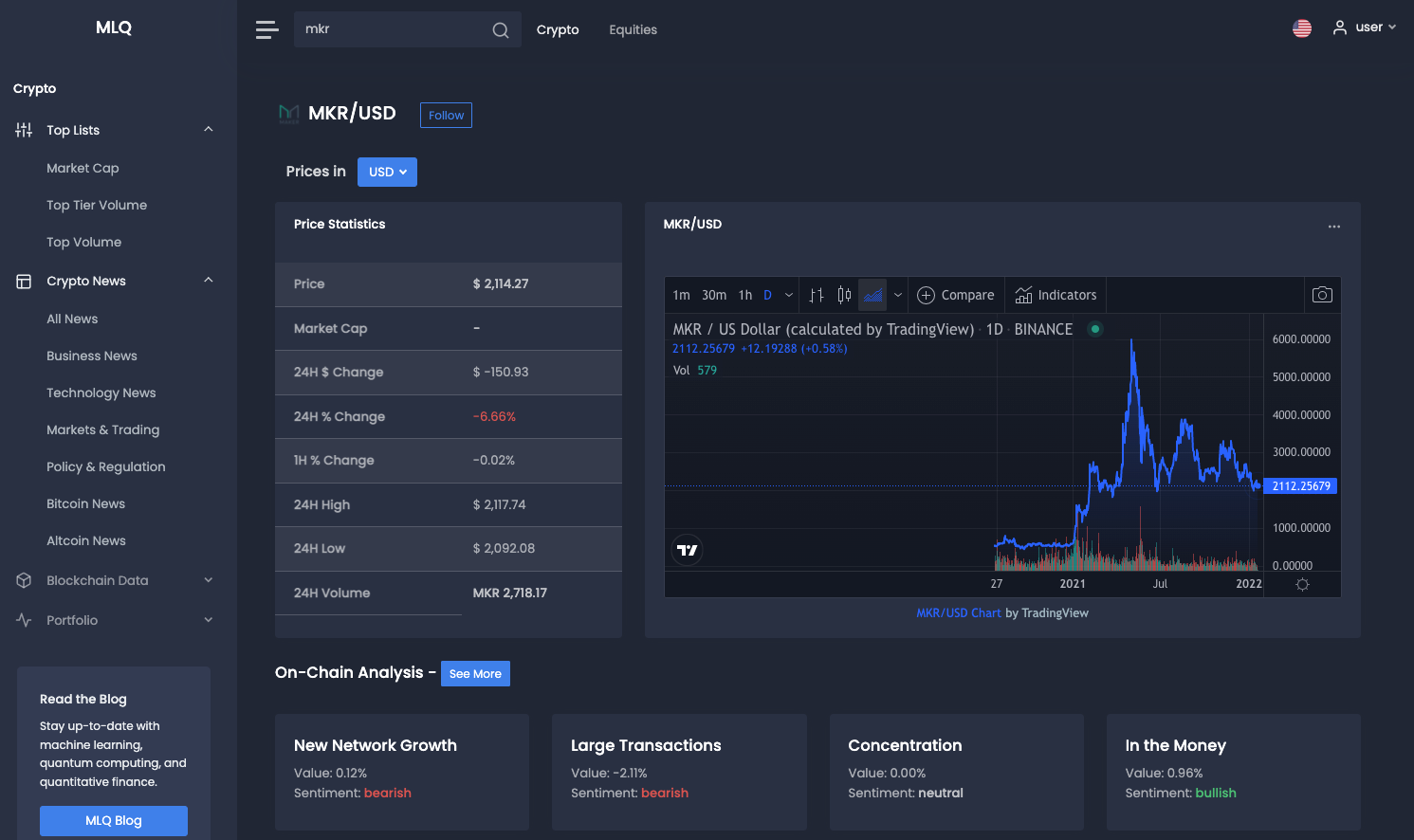

Maker (MKR)

The first thing you will likely notice when you look at the Maker blockchain is the price of its governance token, MKR. Priced at a robust level of over $2,100, this is more of a functionality of the principles of supply and demand.

Currently, there are only 984,000 of a potential 1 million MKR tokens in circulation. MakerDAO works alongside a previously mentioned DeFi token in Dai to create a decentralized lending exchange that allows investors to borrow cryptocurrencies without a lending provider.

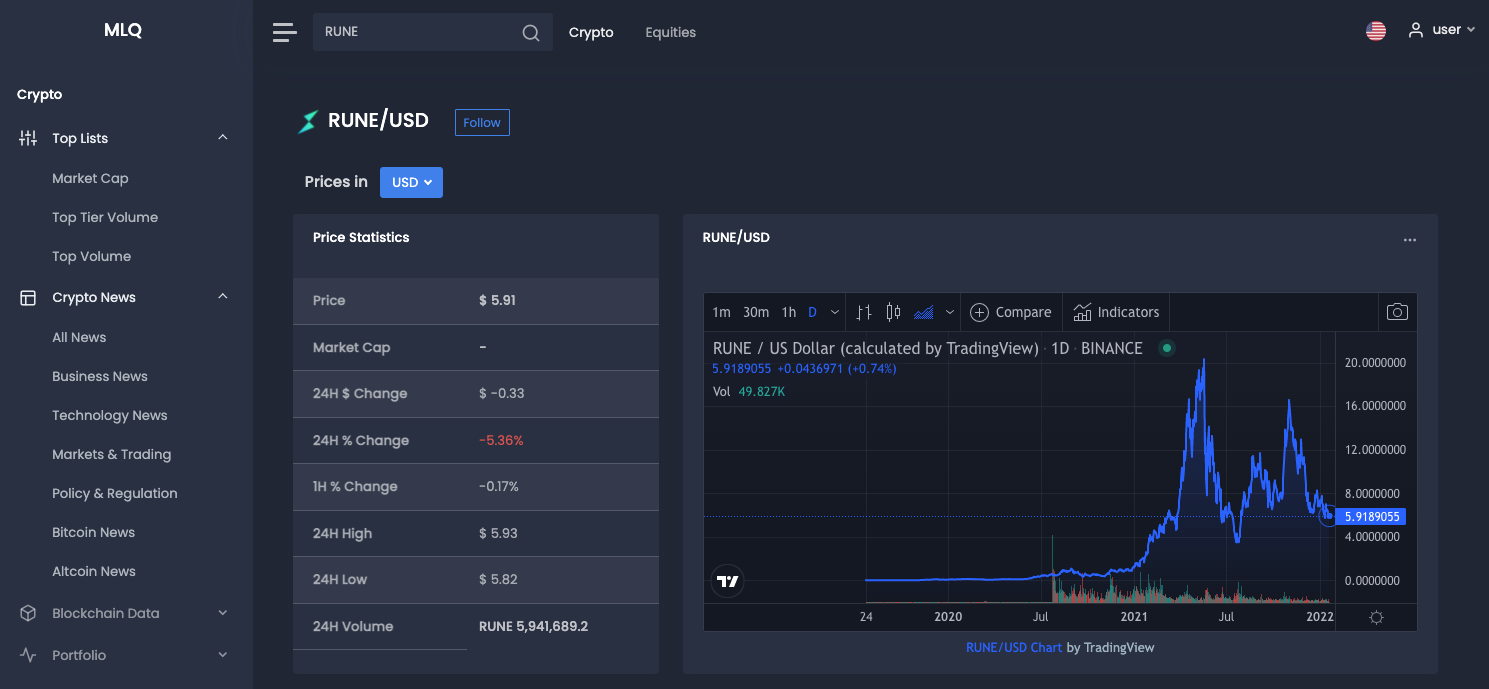

THORChain (RUNE)

Yet another governance token that is selling well below its all-time highs, THORChain hit a high of $21.26 last year but is now trading at under $6.00. THORChain is one of the largest decentralized exchanges on the Binance Smart Chain network, and the team behind it is building an entire suite of DeFi products for BSC investors.

The main purpose for THORChain is to allow users to seamlessly move various cryptocurrencies across multiple different blockchains. By this summer, the THORChain team is hoping to be able to provide full control to the community, which would make it a self-sufficient, proof of stake system.

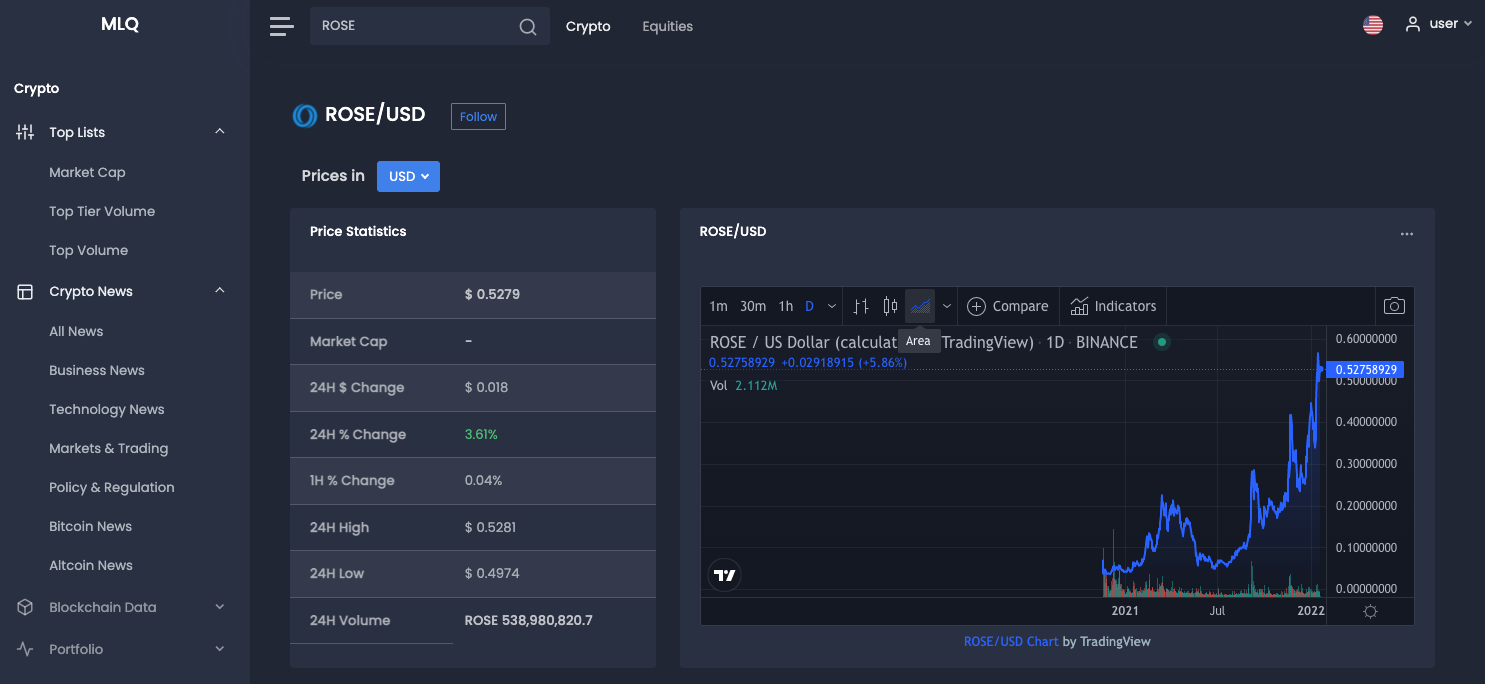

Oasis Network (ROSE)

The Oasis Network has come on as of late with a major push from retail investors. What is the big deal with ROSE? It is the first ever privacy–enabled blockchain platform with an ultimate, long-term goal of a responsible data economy. The Oasis Network team is spread across the world with industry veterans in the financial and blockchain industries. There are a total of 10 billion fixed ROSE tokens that are currently trading near their all-time highs at about $0.51 per token. This could be a great long-term investment if Oasis can ever gain mainstream adoption.

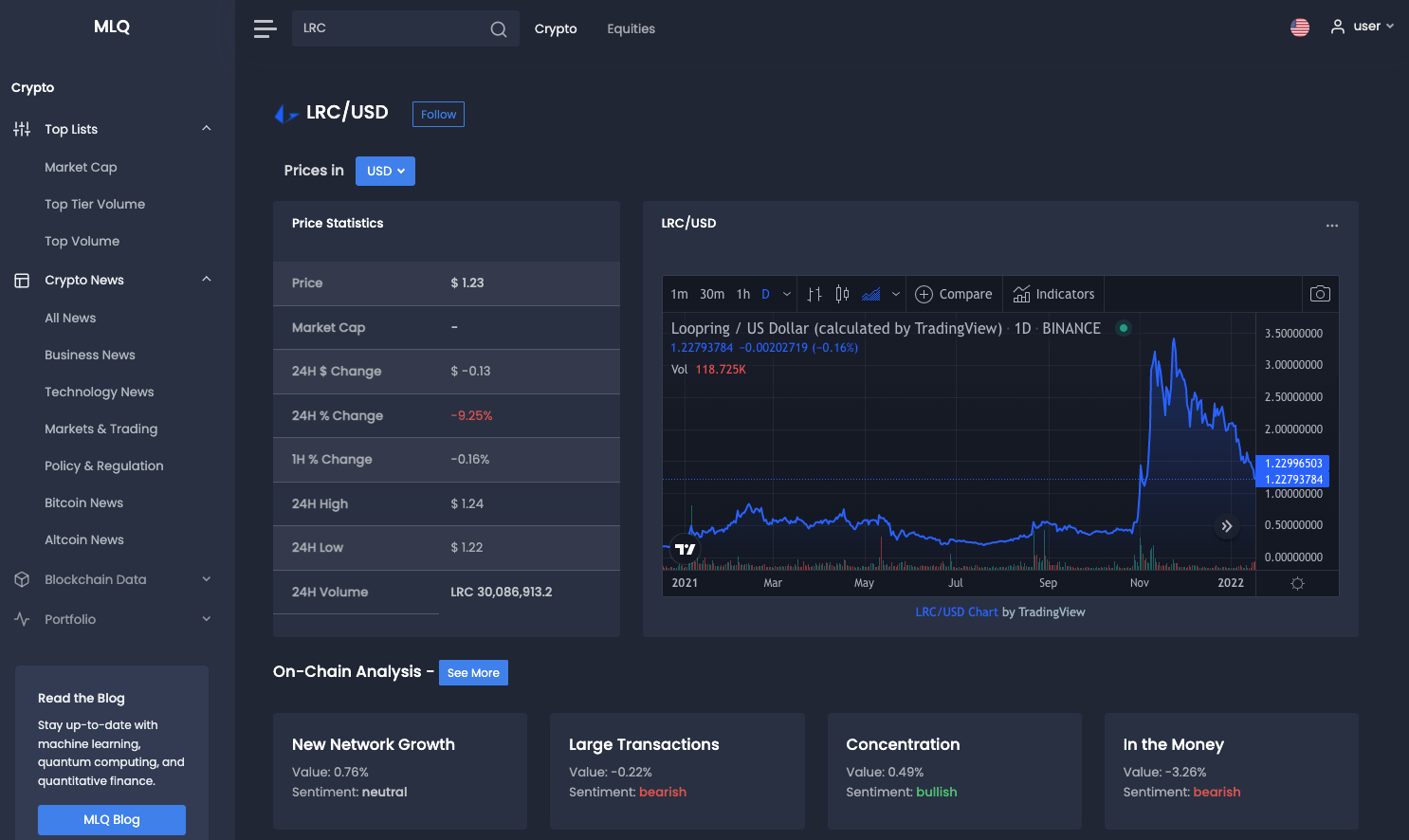

Loopring (LRC)

Loopring made a lot of mainstream noise in late 2021 when it was rumored to be the blockchain of choice for GameStop’s new NFT marketplace. This caused its token LRC to jump up to nearly 4.00 per coin, but it has since come back down to just over $1.20, with the GameStop momentum fading.

Loopring is aiming to build new crypto asset exchanges on its blockchain that will be able to incentivize traders as well as reduce transaction fees that are seen on other blockchains like Ethereum. Even though Loopring is built on Ethereum, it is trying to eventually be a blockchain that works alongside Ethereum to eliminate some of the congestion and wait times that Ethereum can see.

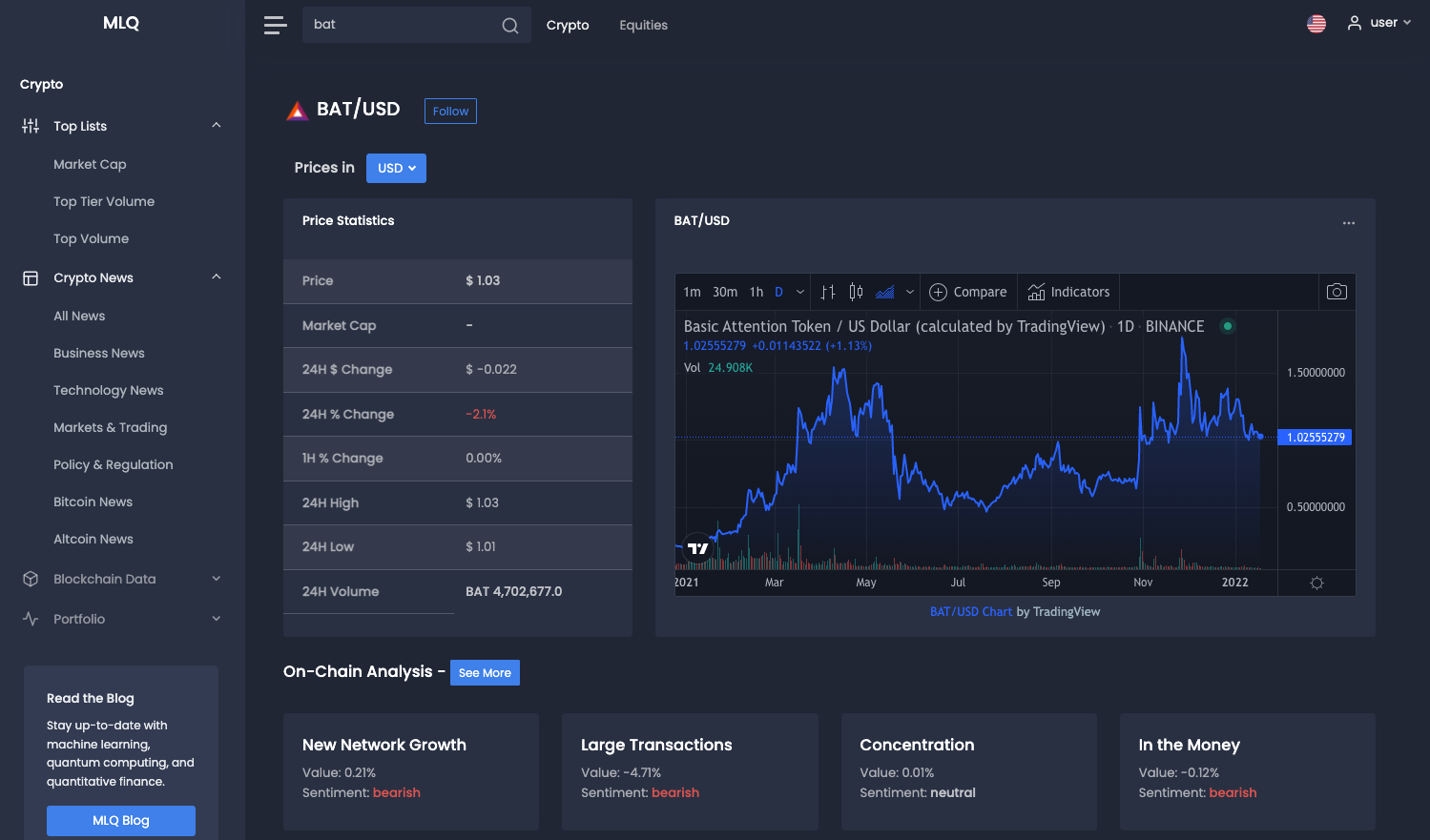

Basic Attention Token (BAT)

Another blockchain with an interesting name and origin. BAT was started by Brendan Eich who was the co-founded of the Mozilla and Firefox browsers. It is built upon the Ethereum network but is intended to incentivize brands to create interesting and compelling digital advertising.

In other words, to hold the attention of consumers. These brands will then be paid more BAT, the longer the users are engaged in the advertising. BAT is the native token that works alongside the BRAVE browser, which brands can use to post digital advertising on the blockchain.

BAT still trades for around $1.00 per token, which is about 50% off of its all-time high of $1.92.

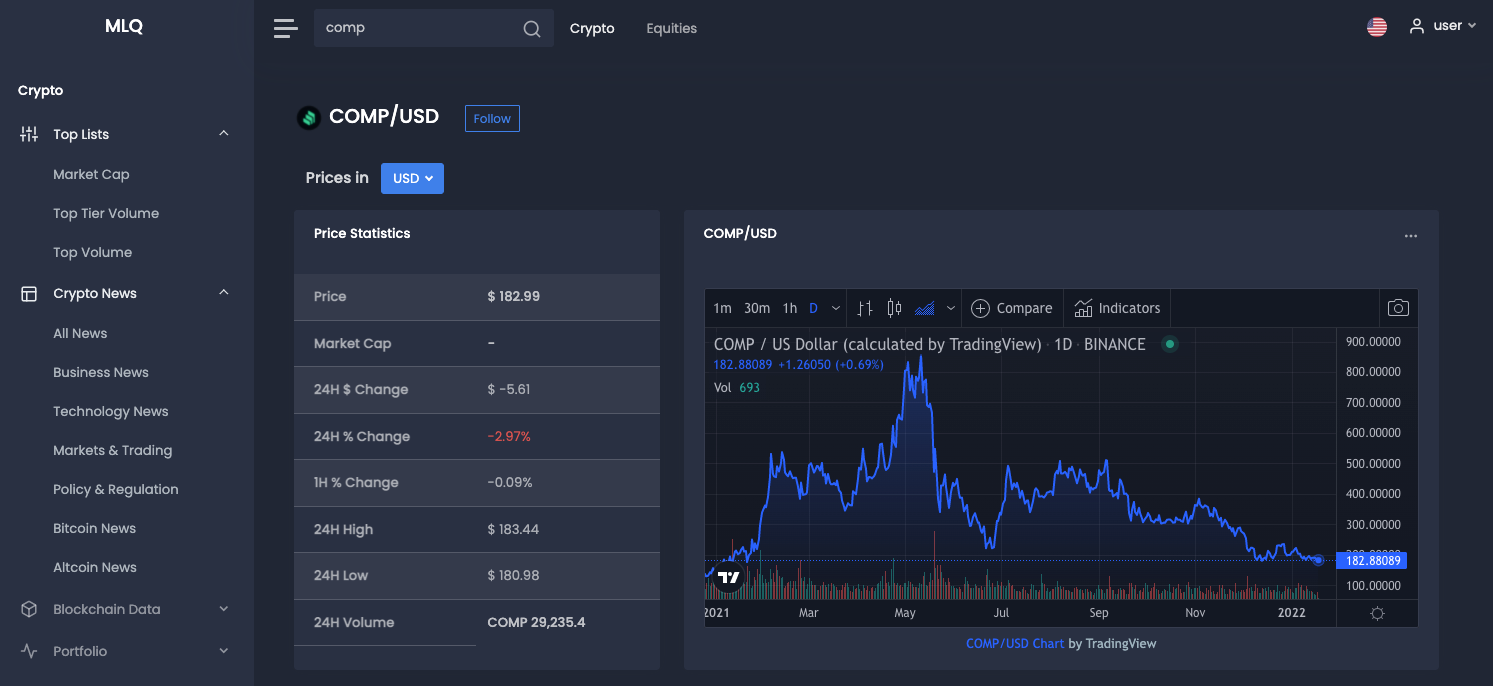

Compound (COMP)

Compound runs on Ethereum and is trying to create a financial system that blends the best of the old and the best of the new. What exactly does that mean? Compound is building an old style money market on the Ethereum blockchain.

It is a simple loan into liquidity pools and earns interest, while borrowers access those lending pools without a centralized lending platform acting as the middleman. Compound has had a tumultuous year of trading, with prices ranging from 166 to $911 per COMP token.

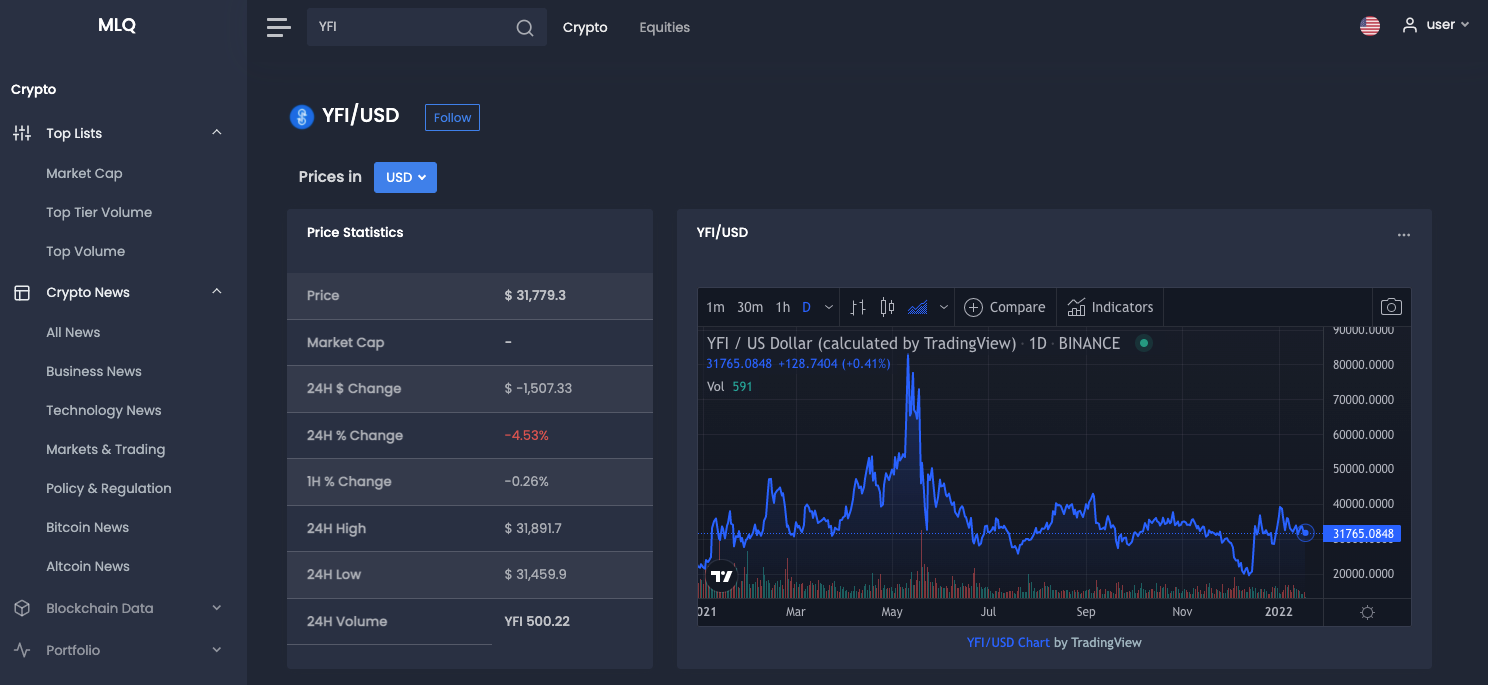

Yearn Finance (YFI)

If you thought Maker was expensive, wait until you see how much a token of YFI costs! Yearn Finance is actually a group of different protocols that create a broader DeFi ecosystem where investors can stake and earn APY or APR in various different liquidity pools.

Yearn was created by Andre Cronke who is somewhat of a legend in the DeFi community, as he has had a hand in other projects including Sushiswap, Pickle, and Hegic.

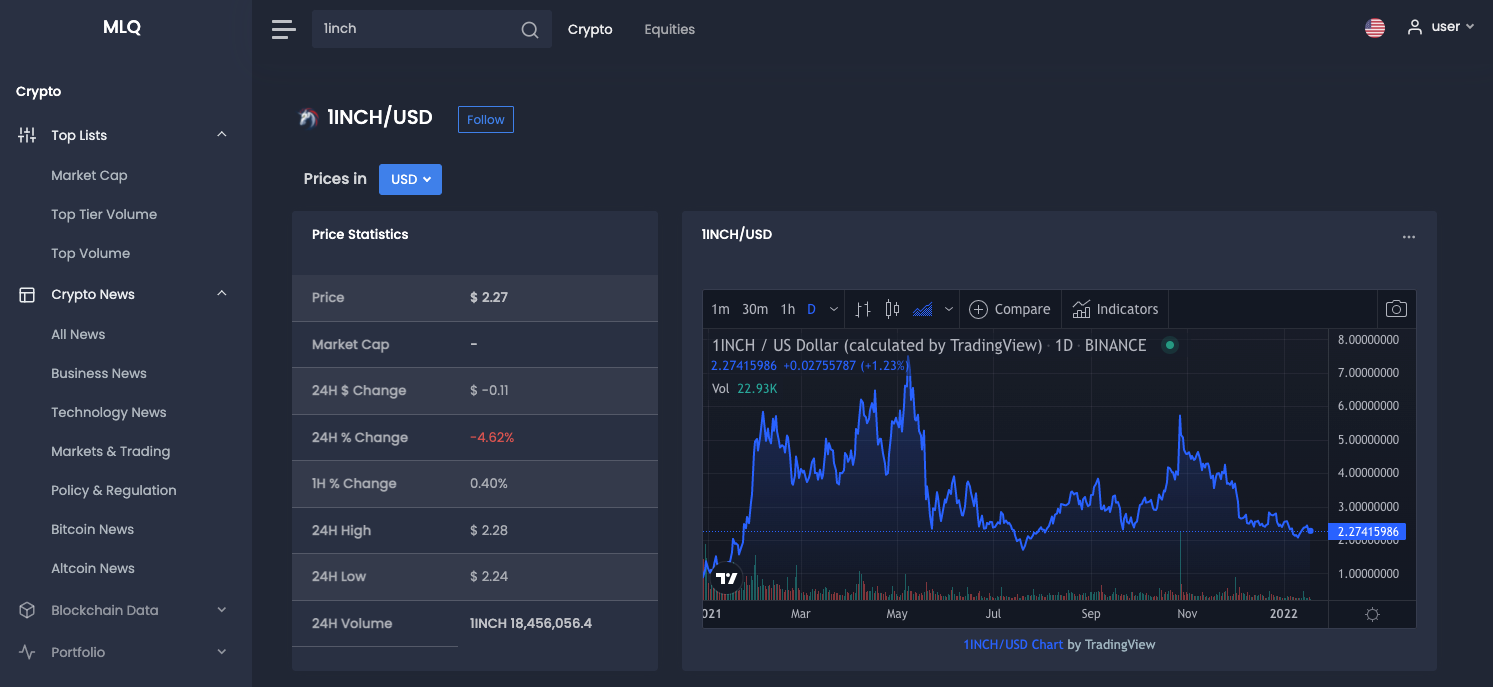

1inch Network (1INCH)

Finally, the last DeFi token you should have on your watchlist for 2022 is the 1inch Network. 1inch is a decentralized exchange aggregator that finds the best possible exchange for your crypto tokens. Not only will 1inch find you the best exchange, it can also split your tokens across several different exchanges to maximize the returns on your portfolio. This will effectively lower transaction fees and eliminate slippage in the future as liquidity concerns will never be an issue.

1inch traded as high as 7.87 per token over the past year, but is currently at just over $2.00 per 1INCH token.

That's it for our list of the top 20 DeFi coins to watch in 2022. We'll be sure to keep this list updated as new, up-and-coming tokens enter the space.